Introduction

The healthcare industry is undergoing a notable disruption primarily driven by technological advancements like AI, regulatory changes, and evolving patient expectations. The impact: There is an urgency for quick integration of virtual assistants into medical billing, a critical component of healthcare industry operations, as more and more companies want to shift from manual paper-based processes to sophisticated digital systems.

The benefits of this pivotal shift are multifold every minute through enhanced operational efficiency, reduced costs, and improved patient care. Want to know how? Read this comprehensive guide to get an in-depth, detailed outlook on how Medical Billing Virtual Assistants (VAs) are reshaping the current dynamics of healthcare operations and why and how healthcare providers are navigating this dynamic landscape using Electronic Health Records (EHRs) and advanced Billing Software.

Evolution of Medical Billing in the Digital Age

Medical billing, which used to be a tedious and inefficient procedure with much involvement in manual operations, has seen a tremendous shift over the past several years. Traditionally, a billing person was supposed to insert the data about patients, insurance policies, and treatment codes into a paper bill or a simple computer program. This method was time-consuming and prone to human error, often resulting in rejected claims and late payouts.

Medical billing has changed to automated and cloud-based systems with the emergence of advanced technology. The current systems enable medical professionals to keep and navigate the billing information in a safe manner via the web, facilitating real-time access from any location and enabling efficiency in interdepartmental cooperation. Scalability is equally present in cloud-based solutions, which allows a practice of any size to respond to shifts in the volume of patients and regulatory changes.

The current adoption of electronic health records (EHRs) has been a game-changer. EHRs combine medical histories, diagnoses and treatments of patients with billing systems, making claims accurate and complete. The development of advanced billing software also automates the submission and tracking of claims, decreasing the chances of an error. ScienceSoft’s long-standing EHR development practice shows how tightly integrated EHR–billing solutions help providers ensure secure PHI handling, improve claim accuracy, and streamline reimbursement workflows.

HIMSS (2024) observed that lightning-fast innovations have reduced the rate of claim denials by 15 to 20 percent and sped up reimbursement cycles to up to 30 percent. This implies that reimbursement to healthcare providers is quicker and with reduced disagreements, therefore enhancing cash flow and efficiency.

Remote Medical Billing in the Digital Healthcare Era

The rising popularity of telehealth, which is being boosted by the COVID-19 pandemic, has essentially changed the way that people receive medical care, with virtual visits comprising a quarter of all visits by 2024 (Source: McKinsey).

Medical billing has also undergone this digital transformation: remote virtual assistants (VAs) can now work using secure platforms and complete billing activities wherever they are located. Consequently, the medical billing outsourcing market valued at USD 5.89 billion in 2024 is estimated to achieve USD 18.74 billion by 2034 as remote billing services grow in demand.

Such a trend of remote billing marries perfectly with the concept of hybrid work, giving medical professionals easier access to flex hours, cost savings, and the potential to maintain high standards of precision and regulatory adherence.

Here’s the proof: Revealing adoption statistics

- Market Growth: Over 36% of U.S. medical practices have adopted outsourced or automated RCM solutions, with VAs playing a significant role (Source: MGMA Stat, 2024).

- Global Trends: The medical billing outsourcing market is projected to grow at a CAGR of 12% from 2025 to 2034, reaching USD 54.17 billion.

- Specialty Adoption: 65% of specialty practices (e.g., cardiology, orthopedics) use VAs for complex coding needs (Source: AAPC, 2025).

- Telehealth Impact: 40% of telehealth providers rely on VAs to manage billing for virtual visits (Source: Healthcare IT News, 2024).

What is a Medical Billing Virtual Assistant?

A Medical Billing Virtual Assistant is a remote professional skilled in managing healthcare billing processes, including claims submission, medical coding, insurance verification, and revenue cycle management (RCM). VAs operate using cloud-based platforms, EHR integrations, and AI-driven tools, providing specialized support to healthcare practices without the need for on-site presence.

VAs are instrumental in reducing administrative burdens, allowing providers to focus on patient care. They enhance financial performance by minimizing claim denials (down by 7-10% with outsourced billing) and improving collection rates (up to 95% with expert VAs). In 2025, VAs are critical for navigating complex payer rules, regulatory requirements, and the shift to value-based care models.

Why Should Your Practice Switch to a Medical Billing Virtual Assistant?

Transitioning to a Medical Billing Virtual Assistant (VA) in 2025 offers healthcare practices a strategic opportunity to enhance operational efficiency, reduce costs, and prioritize patient care. By outsourcing billing tasks to skilled remote professionals, practices can navigate the complexities of modern healthcare while achieving financial and operational goals.

Cost Reduction

Outsourcing billing to VAs also removes the need to have an in-house staff, which immensely reduces costs on salaries, perks, training, and other resources required in the office. Through remote services, practices do not incur the cost of setting up specific workstations or purchasing billing software. This is an affordable method that enables providers to re-divert savings to enhance patient service or broaden the scope of practice.

Scalability

VAs provide more flexible services, which change based on changing demands of healthcare practices, both to accommodate more patients during peak seasons and to reduce the services during off-peak periods. This scalability suits developing practices or one with a fluctuating demand, with only the billing capacity needed when it is required in line with the needs of the operations at hand, without the encumbrance of the fixed labor cost.

Expertise Access

Medical billing VAs are highly specialized and may have certifications such as Certified Professional Coder (CPC) or Certified Coding Specialist (CCS), so they are skilled in medical billing. They are also abreast of changing coding standards, payer policies, and regulatory changes, facilitating the proper filing of claims. This skill minimizes billing errors and almost increases reimbursement rates, delivering reliable billing assistance to the practices without the necessity of training staff internally.

Technology Leverage

VAs are connected to advanced and machine learning-powered billing systems that facilitate the process of claims processing, coding, and denial. These technologies guarantee high levels of correctness in a claim and increase the cycles of reimbursement as they detect errors prior to submission. VAs make use of the latest technological innovations and strive to increase billing efficiency, providing the practice with the opportunity to use modern innovations without making costly infrastructure investments.

Patient Focus

Outsourcing administrative duties such as billing enables providers and staff members to have allotted time to engage patients and deliver care. This is consistent with increased pressure toward patient-centered models of care, where patient-centered experiences and better health outcomes are the focus. VAs relieve practices of labor-intensive billing practices, which allows for giving much more attention to patient relationships and satisfaction.

Compliance Assurance

VAs are trained to adhere to strict regulatory standards, including HIPAA and payer-specific guidelines, ensuring secure handling of patient data and accurate billing practices. Their expertise minimizes the risk of non-compliance, protecting practices from potential audits or penalties. This compliance focus provides peace of mind, allowing providers to operate confidently within a complex regulatory landscape.

Core Services and Responsibilities of a Medical Billing Virtual Assistant

Medical Billing Virtual Assistants (VAs) are essential in managing the intricate financial operations of healthcare practices, ensuring accurate and timely reimbursements while reducing administrative burdens.

Claims Processing and Management

VAs are in charge of managing all the claims, including preparation and submission of a claim, tracking, and resolution. They use AI-backed databases to sift claims of mistakes and make them accurate to be submitted to the payers. VAs simplify processes, decrease denials, and increase reimbursements faster, making the practice’s cash flow, by focusing on high-value claims and tracking their statuses.

Medical Coding (ICD-10, CPT, HCPCS)

Accurate coding is very crucial in receiving reimbursements. VAs use standard codes like ICD-10, CPT, and HCPCS and remain abreast with yearly updates and new ones like ICD-11, which has specialized codes for rare diseases. Their knowledge and AI-powered tools guarantee an accurate code so that their coding would have few errors and would result in the refusal of claims because of undercoding or not fitting the requirements.

Insurance Verification and Authorization

VAs will ensure that patients have insurance coverage and that pre-authorization is provided before services are rendered. With real-time cloud-based applications, they authenticate coverage and eligibility information and ensure that claims meet the needs of the payers. This initiative minimizes the denials based on technical eligibility, saving not only on the billing front but also creating a conducive environment on the reimbursement side.

Patient Billing and Payment Processing

VAs produce transparent and easy-to-read bills and process payments by utilizing safe online platforms. They are well-trained and respond to patient questions professionally, clarifying the billing procedures, which will increase satisfaction. Through the ability to pay conveniently and the willingness to communicate in a timely manner, VAs enhance collection rates and positive patient experiences, which build confidence in the practice.

Accounts Receivable Management

It is the responsibility of VAs to carefully oversee unpaid claims by following up the accounts receivable. They rely on automated tools and analytics to determine delayed payments, and follow-ups are made to emphasize such payments to payers. This methodical way would shrink outstanding balances, enhance cash flow, and ensure that the practice remains financially healthy.

Denial Management and Appeals Process

With refuted claims, VAs examine causes and correct mistakes and file appeals to gain the declined revenue. They use AI-assisted applications to recognize possible problems prior to submission to curb denials. Because of their experience with payer policies, they will appeal successfully, and thereby guarantee the best reimbursement rates and achieve a low financial loss to the practice.

Collections and Follow-up Procedures

VAs also have systematic follow-ups of the outstanding accounts that is done by automated reminders to pay. They also negotiate patient payment plans to match their financial requirements to allow a patient-centric approach. Due to the consistent communication process, VAs diminish bad debt and improve collection rates, working in favor of the sustainability of practice.

Advanced Services and Specializations

Medical Billing Virtual Assistants (VAs) provide sophisticated services that extend beyond basic billing functions, offering specialized expertise to enhance practice efficiency and financial outcomes. In 2025, these advanced capabilities are vital for healthcare providers navigating intricate revenue cycles and regulatory demands. Let’s dig deeper and get a comprehensive look at the services and specializations:

Revenue Cycle Management Optimization

VAs help improve the revenue cycle due to efficiency in the cycle processes, such as the patient admission stage and final payment collection. They define inefficiency in scheduling, coding, submission of claims, and follow-ups with ease of transition between the various stages. Through predictive tools, VAs also foresee pending problems such as the rejection of claims, beforehand. Hence, they can make prior changes that enhance cash flow and optimization of revenue for practices.

Financial Reporting and Analytics

Real-time and user-friendly dashboards provided by VAs correspond to crucial billing indicators, such as claim status, payment dashes, and the performance of collections. These insights will enable practice leaders to identify areas of operational delays and to make informed decisions using data. VAs can aid in prioritizing high-value claims and maximize billing strategies, as well as enhancing financial stability within a practice due to their analysis of financial trends.

Audit Support and Compliance Monitoring

VAs keep records that are compliant since they are meticulous, audit-ready records that meet CMS, HIPAA, and payer standards. They pay constant attention to compliance with the constantly changing rules, minimizing the possibility of a deficiency. This arrangement helps in the preparation of practices during audits, hence promoting transparency and minimizing risks of potential penalties or altercations with payers.

Practice Management Software Integration

VAs can be combined with practice management systems and align both billing and clinical processes. This connectivity reduces manual data entry errors and increases working efficiency. VAs facilitate efficiency in practices, achieving smoother processes by maintaining proper data flow between platforms so that the practices can concentrate on providing more quality care to the patients.

Electronic Health Records (EHR) Management

VAs use EHRs to upgrade and synchronize the information in their check bills with that in the clinical records. They ensure that documented care and coded procedures are in agreement, thereby minimizing the errors that might result in the owing of claims. The efficient management of EHR increases the accuracy of billing and facilitates the European standards of the industry.

Patient Payment Plan Administration

VAs create and oversee customized patient payment plans, making healthcare costs more manageable for patients. By offering transparent billing options and handling payment follow-ups, they improve collection efficiency and patient satisfaction. This patient-focused approach builds trust, encourages timely payments, and supports the practice’s financial health.

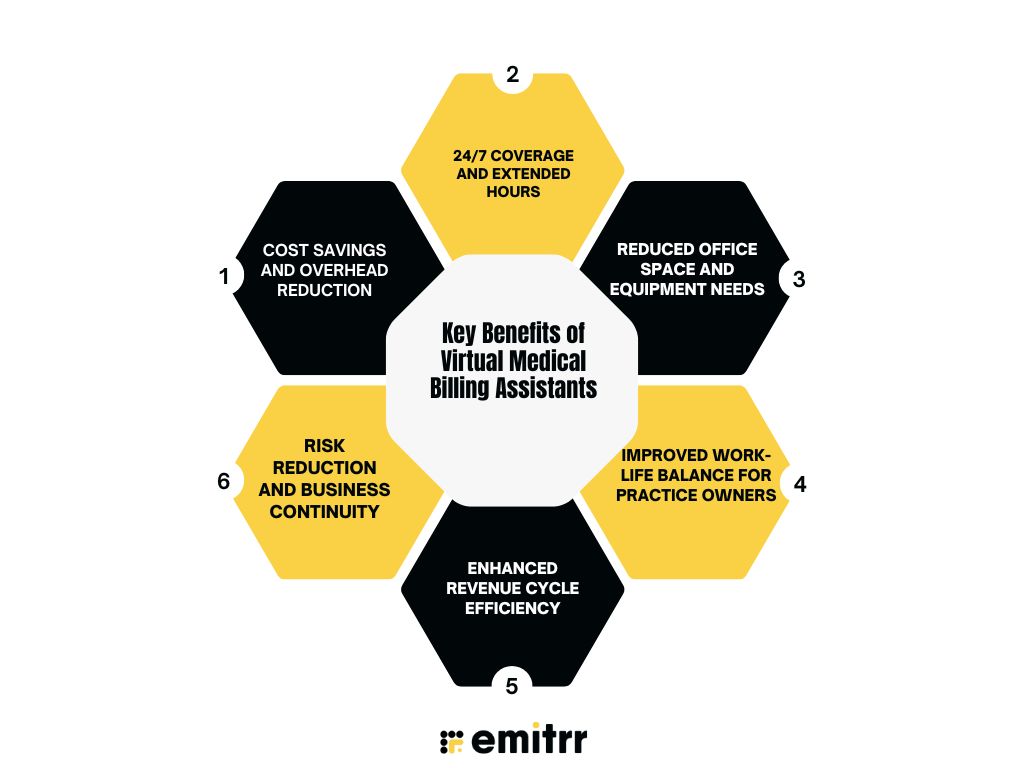

Key Benefits of Virtual Medical Billing Assistants

Medical Billing Virtual Assistants (VAs) offer transformative advantages for healthcare practices, streamlining operations and enhancing financial performance. These benefits—ranging from cost savings to improved work-life balance—are critical for practices navigating a complex healthcare landscape. By leveraging benefits below, Medical Billing Virtual Assistants empower practices to achieve financial efficiency, operational resilience, and a renewed focus on patient care.

Cost Savings and Overhead Reduction

Hiring VAs significantly reduces operational expenses by eliminating the need for in-house billing staff, including salaries, benefits, and training costs. By leveraging cloud-based billing platforms, VAs further minimize IT infrastructure expenses, such as server maintenance or software licenses. This cost-effective approach allows practices to allocate resources toward patient care or strategic growth initiatives, enhancing financial sustainability.

24/7 Coverage and Extended Hours

Remote VAs provide round-the-clock billing services, ensuring continuous claims processing, follow-ups, and patient inquiries, even outside traditional office hours. This flexibility accelerates reimbursement cycles and maintains operational continuity during staff shortages or peak periods. Practices benefit from uninterrupted cash flow and enhanced responsiveness, meeting the demands of a dynamic healthcare environment.

Reduced Office Space and Equipment Needs

Virtual billing services eliminate the need for dedicated on-site workstations, office space, and equipment like computers or printers. By operating remotely, VAs reduce facility-related expenses, allowing practices to optimize physical space for clinical activities or patient amenities. This streamlined approach enhances operational efficiency and lowers overhead costs significantly.

Improved Work-Life Balance for Practice Owners

Outsourcing billing tasks to VAs alleviates the administrative burden on practice owners, reducing stress associated with managing claims, denials, and collections. This allows providers to focus on patient care, strategic planning, and personal well-being. A better work-life balance fosters sustained engagement and productivity, benefiting both the practice and its leadership.

Enhanced Revenue Cycle Efficiency

VAs optimize the revenue cycle by streamlining claims submission, coding accuracy, and payment follow-ups. Using AI-driven tools, they ensure clean claims and faster reimbursements, minimizing denials and delays. This efficiency boosts revenue, improves cash flow, and allows practices to invest in quality care and operational growth.

Risk Reduction and Business Continuity

VAs ensure compliance with HIPAA, payer guidelines, and billing regulations, reducing the risk of costly audits or penalties. Their remote operations provide resilience during disruptions, such as staff turnover or emergencies, ensuring uninterrupted billing processes. This reliability safeguards financial stability and supports long-term practice continuity.

Compliance and Regulatory Requirements

Compliance with regulatory standards and data security is paramount for medical billing, given the sensitive nature of patient information and the complexity of healthcare regulations. Medical Billing Virtual Assistants (VAs) play a critical role in ensuring adherence to these standards and safeguarding practices from legal and financial risks.

Let’s delve deeper into notable compliance and regulatory requirements every Medical Billing VA must be aware of:

HIPAA Compliance and Data Security

HIPAA compliance is among the priorities of medical billing VAs in protecting patients’ health information. To convey and store data, they use end-to-end encryption, which is confidential. This is an additional layer of security when unauthorized access on the multi-factor level. To ensure that VAs are compliant, it is useful to conduct regular security audits and train employees on the HIPAA guidelines to address the risks of data breaches and patient assurance in this age of a rising risk of cyberattacks.

State and Federal Billing Regulations

VAs ensure that they are up to date with Medicare, Medicaid, and state-specific billing laws to maintain compliance in practices. They adjust to the changing regulations, such as those with value-based care models, which focus on patient outcomes rather than the volume of the provided services. Complying with these regulations, VAs assist practices in evading the penalties, retaining reimbursement eligibility, and effectively evaluating federal and state healthcare policies.

Insurance Company Requirements

Each insurance payer has unique billing guidelines, which VAs meticulously follow to ensure accurate claims processing. They stay updated on payer-specific policies through real-time resources and training, minimizing claim denials due to non-compliance. This diligence ensures smooth interactions with insurers, accelerates reimbursements, and reduces administrative burdens for healthcare practices.

Audit Trail and Documentation Standards

VAs have processed records that are complete, well-organized, of all billing transactions that establish distinct audit trails to ensure transparency and accountability. Exhaustive documentation covers claim submission records, coding choices and payment records and leaves the organization prepared to go through regulatory audits. The risk of being hit with audit-related fines decreases as VAs follow standardized documentation practices, which increases the trust in operations.

Quality Assurance Protocols

To ensure high accuracy and compliance, VAs implement rigorous quality assurance protocols. Regular error checks on claims and coding, combined with periodic compliance reviews, help identify and correct issues before they escalate. These proactive measures uphold billing precision, minimize legal risks, and ensure practices meet regulatory and payer expectations consistently.

Future Trends and Innovations in 2025 and beyond

The medical billing landscape in 2025 is being transformed by cutting-edge technologies that enhance efficiency, security, and accuracy. These innovations enable Medical Billing Virtual Assistants (VAs) to deliver unparalleled value to healthcare practices. Below, we explore key trends elaborating on their applications and impact.

Artificial Intelligence and Automation

Medical billing is being revolutionized by Artificial Intelligence (AI) and automation that helps to facilitate the repetitive roles in medical billing, including workflows related to claims processing, coding, and denial management. Claims scrubbing, code assignment, and prioritization allow solution providers to do less manual work by automatically and intelligently scrubbing, assigning appropriate codes, and prioritizing high-value. Automation increases the rates of reimbursement and reduces human error, ensuring that only sophisticated jobs are done by VAs, and healthcare practices boast of higher efficiency in their billing.

Predictive Analytics in Revenue Cycle Management

Predictive analytics transforms Revenue Cycle Management (RCM) by providing actionable insights into claim acceptance probabilities and payment trends. These tools analyze historical and real-time data to forecast potential denials or delays, allowing VAs to proactively address issues. By optimizing billing strategies, predictive analytics enhances cash flow, reduces financial uncertainty, and supports data-driven decision-making for practice administrators.

Blockchain Technology in Medical Billing

Blockchain technology brings safe, transparent, and unalterable records of transactions into medical billing. Blockchain also enhances the integrity of claims and payment transactions by creating decentralized ledgers of these data. Notwithstanding such challenges as the complexity of infrastructure, its implementation leads to the increased levels of trust between payers, providers, and patients, making the billing processes more streamlined and ensuring compliance with regulatory standards.

Voice Recognition and Natural Language Processing

NLP (Natural Language Processing) and voice recognition allow quick documentation and coding, as they process spoken clinical notes into structured data. This is particularly useful because these tools can help VAs effectively capture information related to billing, cutting down on administrative time and increasing the accuracy of coding. Voice AI increases the productivity of documentation and enables practices to prioritize patient care without sacrificing the accuracy of billing documents.

Enhanced Cybersecurity

As cyber threats grow, enhanced cybersecurity measures are critical for protecting sensitive billing data. AI-driven threat detection identifies and mitigates risks in real time, while blockchain ensures secure data storage. Biometric authentication adds an additional layer of protection, safeguarding patient information. These advancements enable VAs to maintain HIPAA compliance and build patient trust in an increasingly digital healthcare environment.

Common Use Cases of Medical Billing Virtual Assistants

Medical Billing Virtual Assistants (VAs) offer versatile solutions tailored to diverse healthcare settings, enabling practices to streamline billing, enhance efficiency, and focus on patient care. In 2025, VAs are increasingly integral across various practice types, addressing unique operational and financial challenges.

Below, we explore key use cases, illustrating how VAs support different healthcare providers in optimizing their revenue cycles:

Small Practices

Small practices and solo practitioners usually have fewer resources available, and thus, in-house billing staff is unrealistic. VAs are a cost-effective option that has assumed the role of handling all the billing procedures, including the filing of claims and invoicing patients. This will enable the small practices to continue with the practice in sound financial conditions since they will not be affected by the additional overhead of full-time employees, and the providers will have ample time to concentrate on taking care of the patients and sustaining the practice.

Specialty Clinics

Complex coding is a challenge that experts in specialty clinics, cardiology, orthopedics, or oncology are confronted with as they deal with complex procedures and treatment. Specialty-specific coding in VAs allows proper use of ICD-10, CPT and HCPCS codes, mitigating the risk of claim denials. Their accuracy makes it possible for regular reimbursement of clinics, helping them concentrate on providing specialized care of the highest quality.

Multi-Location Practices

Practices that have more than one location need a synchronized billing process in order to keep their practices consistent and compliant throughout the multiple locations. VAs central bills, arranging claims, coding and collections in an efficient manner. VAs drive operating efficiency through workflow standardization plus the connection of new workflows with practice management systems, enabling multi-location practices to continue with a unified financial control as they grow in locations.

Telehealth Providers

The emergence of telehealth has spawned unprecedented billing issues, such as the adherence to virtual visit policies and plans payers. VAs are able to skillfully remit telehealth services, attest to all insurance coverage, code virtual visits, and bill claims. This experience offers an assurance of on-time reimbursements, a factor that helps telehealth providers to administer accessible care on a financially sustainable basis.

Healthcare Startups

Many startups in the medical practice and healthcare, in general, are associated with high startup costs and lack any existing infrastructure. VAs help emerging entities set in place effective methods of billing without substantial investments in personnel or technology. VAs work on end-to-end billing operations, which means that they help startups expand their businesses, attract new patients, and become sustainable in an intensely competitive environment.

Choosing the Right Medical Billing Virtual Assistant

Selecting the right Medical Billing Virtual Assistant (VA) is a critical decision for healthcare practices aiming to optimize their billing processes while maintaining compliance and efficiency. In 2025, the landscape of medical billing demands VAs who are skilled, technologically adept, and aligned with your practice’s unique needs.

Here’s a detailed exploration of key considerations to guide you in choosing a VA who can enhance your practice’s financial performance, streamline operations, and support long-term growth.

Certifications and Specialized Expertise

When evaluating a VA, prioritize those with recognized certifications, such as Certified Professional Coder (CPC) or Certified Coding Specialist (CCS). These credentials ensure proficiency in medical coding, billing regulations, and industry best practices. Additionally, seek VAs with experience in your practice’s specialty, such as cardiology, orthopedics, or primary care. Specialty-specific knowledge allows the VA to navigate complex coding requirements and payer policies, ensuring accurate claims and minimizing denials.

Technology Compatibility and Innovation

A competent VA should seamlessly integrate with your practice’s existing technology, including Electronic Health Records (EHRs) and practice management software like Epic, Athenahealth, or Kareo. Verify that the VA uses advanced tools, such as AI-driven coding platforms or cloud-based billing systems, to enhance efficiency and accuracy. Compatibility with your systems ensures smooth data flow, reduces manual errors, and supports real-time tracking of claims and payments, aligning with modern healthcare’s digital demands.

Compliance and Data Security

Maintaining regulation standards is not an option in medical billing. Make sure the VA is thoroughly trained on the HIPPA regulations in order to safeguard patient information. Seek out strong cyber security protocols, like end-to- end encryption, secure cloud environments, and periodic carriage oriented checks and balances against data breaches. The well-structured compliance procedures of a VA reduce legal risks and keep your practice in compliance with federal, state, and payer-specific regulations and help patient trust.

Responsive Communication and Support

The key to an effective VA partnership is proper communication. Select a VA that has 24/7 support to deal with billing questions, technical problems, or any urgent requirements. The collaboration is smooth due to the presence of dedicated account managers or responsive support teams in peak billing periods or during any unforeseen difficulty. Focus on VAs that deliver regular status updates on their claims, denials, and revenue achievements, and a sense of transparency and trust.

Transparent and Flexible Pricing Models

The main benefit of using a VA is cost-effectiveness. Choose the providers who have transparent pricing models like per claim, hourly or subscription models that best fit into the budget and work volume of your practice. Consider the adaptability of the pricing model to changing volumes of patients or to seasonal needs. In a transparent payment system, you can manage the costs as you get access to specialized expertise on billing so VAs are more cost-effective than in-house employees.

Aligning with Your Practice’s Goals

A good VA must have the ability to provide high and low volume services as your practice expands. This applies whether you are a single practitioner, specialty clinic or a multi-location practice. Consult with prospective VAs or give them a demo in order to assess their familiarity with your requirements and their capability to offer unique solutions. Healthy partnership results in the effective functioning of the organization, financial sustainability, and an improved patient experience.

Getting Started With Emitrr: Your Ideal Virtual Assistant

Emitrr is a leading provider of Medical Billing Virtual Assistant (VA) services, offering tailored solutions to streamline healthcare billing with advanced technology and dedicated support. Starting with Emitrr is simple; simply visit Emitrr.com to schedule a free demo, where a specialist will evaluate your practice’s needs and propose a customized plan. Post-demo, Emitrr guides you through onboarding, system integration, and ongoing support, ensuring a hassle-free transition to virtual billing.

By partnering with Emitrr, practices can reduce administrative burdens, streamline billing, and prioritize patient care. Below are the key features and steps to begin, designed to guide healthcare providers in transforming their billing processes.

Seamless Onboarding Process

The migration to virtual billing becomes simple with Emitrr as it offers a free guided onboarding experience. Practices are individually configured and trained; they swiftly adapt with the established EHRs and practice management software. This is a seamless process that reduces distractions, enabling the providers to embrace the VA services effectively and keep concentrating on the health of the patients.

Customized Solutions for Specialties

Emitrr specializes in its services to the specific billing requirements of patients of medical specialties such as cardiology, orthopedics, primary care, and more. Emitrr decreases time and maximizes the revenue cycle to optimize the practices to cater to unique operational needs – the credit goes to the support for specific specialty coding and billing requirements.

24/7 Dedicated Support

At Emitrr, we are always available for support because we have special account managers who will be ready to help as soon as possible with billing or technical issues. Such prompt service means that the practices will be able to respond to issues promptly, and it can continue its billing operations without disruption even when experiencing peak hours or when staff members are out, or when faced with unforeseen problems.

HIPAA-Compliant Security Measures

Emitrr values the safety of data, as end-to-end encryption and innovative options such as blockchain are used to guarantee the privacy of patient information. The given HIPAA-compliant measures protect the practices against the violence of cyberspace and guarantee compliance with the rules and patient confidence due to the high level of data protection procedures.

Real-Time Performance Analytics

Emitrr offers intuitive dashboards that provide real-time insights into key billing metrics, such as claim statuses and revenue trends. These analytics empower practices to make informed decisions, identify inefficiencies, and optimize their revenue cycle while driving financial growth and operational success.

Recommended for watching:

Frequently Asked Questions

A Medical Billing Virtual Assistant optimizes the processing of claims, lowers accounts receivable days, and limits denials of claims due to proper coding and follow-ups on the claims. VAs increase cash flow by collecting denied revenue and by increasing reimbursement velocity in order to stabilize finances in your practice.

VAs manage insurers and claims, coding of medical data, and verification of insurance, billing of patients, and financial analysis. On processing such time-consuming tasks, they relieve staff to take care of patients and reduce administrative workloads to a great extent, which enhances the efficiency of healthcare providers.

The remote medical billing VA employs the latest artificial intelligence-based tools and certifications to validate the patient data and assign proper codes. This will help to meet the payer requirements, minimize mistakes, increase the number of successful claims, and, therefore, lead to quicker and more confident practice insurance reimbursement.

By employing a virtual assistant, costumes such as salaries, benefits and office space are saved. VAs can produce scalable, pay-per-service models, which means that practices do not have to have a fixed overhead to employ specialized skills, and thus they can attain a more cost-effective approach than employing in-house billing personnel.

Having a virtual medical billing assistant helps save money, raise sales by effectively processing claims, compliance with laws and regulations, as well as satisfy patients due to easy billing. This enables the clinics to direct their attention to care delivery yet gain better economic and financial efficiency.

Conclusion

The dynamic Healthcare Virtual Assistants (VAs) landscape is shifting its focus more towards Medical Billing. This shift is expected to transform the industry with affordable, efficient, and compliance-based Medical Billing VA solutions. The trusted provider, Emitrr, offers customized VA services effectively interconnected with practice systems to ensure an easy onboarding process.

To bill correctly, our systems are specialty-focused, and offer 24/7 support around the clock with HIPAA-compliance, encryption, and blockchain to protect data. Revenue and efficiency are optimized with real-time analytics. Partnering with Emitrr brings down the cost, enhances the billing process and focuses on patient care to ensure that the practices survive in a dynamic healthcare environment.

Visit: [Emitrr.com] to give your practice a trial.

4.9 (400+

reviews)

4.9 (400+

reviews)