Introduction

Artificial Intelligence (AI) has changed the whole financial services industry. AI in fintech has given rise to smarter, faster, and more secure financial experiences, which range from instant loan approvals to fraud detection and personalised banking.

Financial technology, or Fintech, is the use of digital tools that make the delivery of financial services more efficient. These tools, when combined with AI, perform functions beyond automation. They are capable of learning from data, changing according to the user’s behaviour, and making decisions in real-time.

To quote Google Cloud and Emitrr, AI is a powerful force that drives innovations in credit scoring, customer support, investment management, and risk monitoring. Many fintech startups and traditional banks believe that AI is already a competitive necessity rather than an option.

The whole range of technologies, use cases, advantages, and future developments of artificial intelligence in fintech are discussed in this article and also why it is reinventing the financial world.

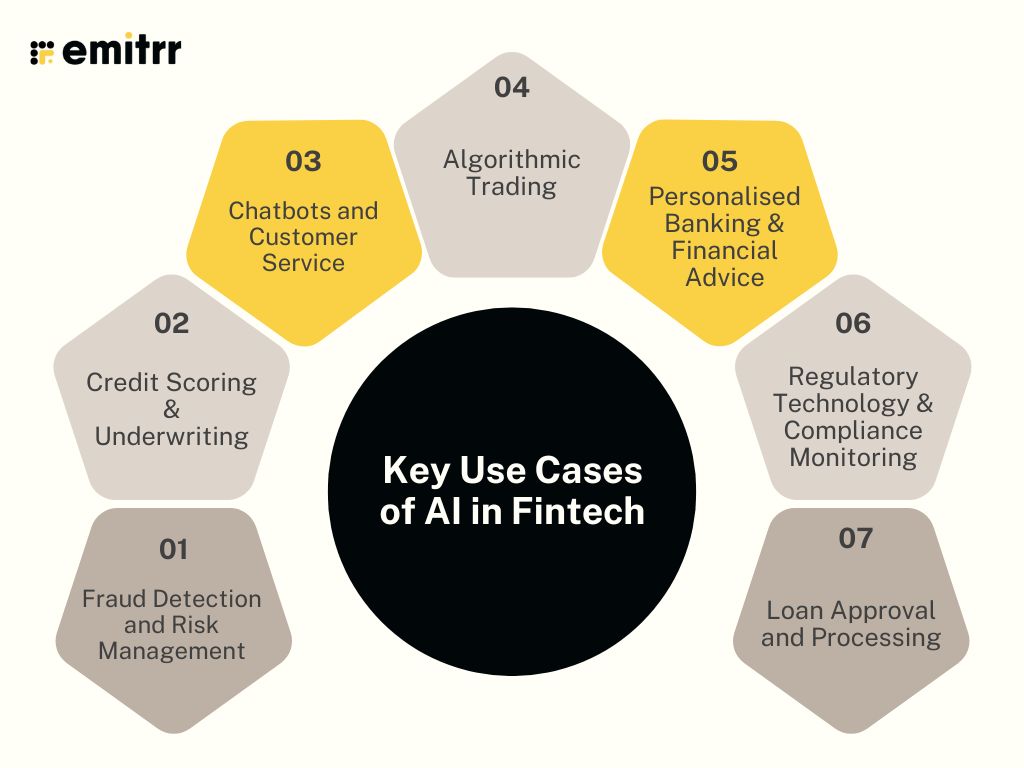

Key Use Cases of AI in Fintech

A. Fraud Detection and Risk Management

Fraud detection has become the most critical task for fintechs due to the surge in digital transactions. AI models can:

- Monitor and compare users’ behaviour records and spending habits; in this way, they search for anomalies and detect them in real-time

- Stop suspicious transactions by sending alerts, and thus, prevent them from being carried out

- Keep learning from the new fraud techniques and thus, get better at reacting to the threat.

This positions AI at the forefront of risk management and anti-money laundering (AML) operations.

B. Credit Scoring & Underwriting

Conventional credit scoring generally only involves individuals who have a formal credit history; thus, large populations of people may be left out. AI revolutionises the underwriting process in that:

- It looks into the auxiliary data such as the situation of one’s income, the consumption of telephone, and the digital behaviour that individuals exhibit.

- It makes the risk assessment more accurate for the small borrowers who are not properly served.

In this manner, the process of lending can be carried out faster as well as in a more inclusive manner, especially in emerging markets.

C. Chatbots and Customer Service

In a very short period, artificial intelligence, in the form of chatbots, has become a go-to solution for customer engagement in fintechs:

- Providing 24/7 multilingual support through apps and websites

- Generating intelligent responses to users and AI-based query resolution, thus, not only does it improves UX but also

D. Algorithmic Trading

Predictive and high-frequency trading is dominated by AI through:

- Bulk data processing to predict market trends

- Running standalone trading robots, making decisions in milliseconds.

This assists organisations in developing a competitive edge in volatile financial markets.

E. Personalised Banking & Financial Advice

AI empowers digital banking to implement hyper-personalisation:

- Robo-advisors use artificial intelligence to recommend investment strategies that align with an individual’s risk tolerance.

- Personal finance platforms provide budgeting insights in real-time.

This makes wealth management affordable to a broader spectrum of users.

F. Regulatory Technology & Compliance Monitoring

AI enables the automation of major compliance activities, thus allowing fintechs to operate efficiently while being in line with updated regulations:

- Facilitates the monitoring of transactions for any irregularities

- Produces regulatory reports on the condition of compliance in real time

- Assists in KYC and AML tasks by employing facial recognition technology and performing ID verification.

This approach not only reduces compliance costs but also improves accuracy.

G. Loan Approval and Processing

AI is cutting down turnaround periods in loan processes through:

- Verifying documents automatically by using OCR and NLP

- Deciding on applications instantly with AI-based risk models.

The quickened pace of approvals and improvement of the user experience, particularly in digital lending platforms.

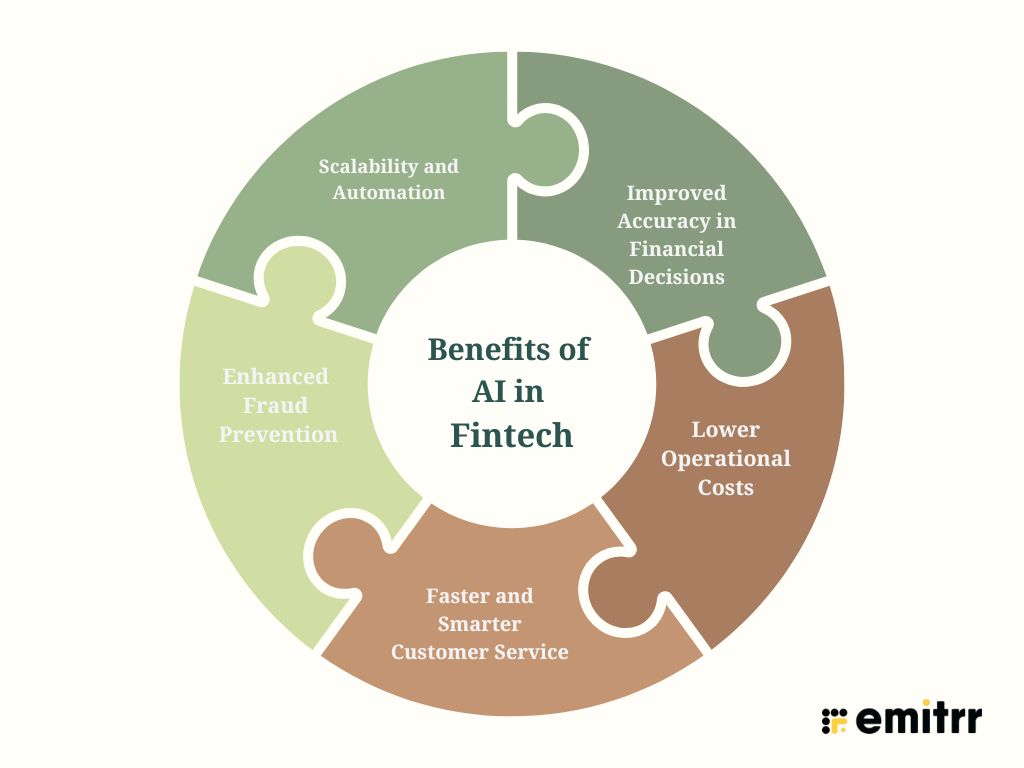

Benefits of AI in Fintech

The use of artificial intelligence in fintech has been positive in areas of performance, compliance, and customer satisfaction that can be demonstrated. The essential benefits that make AI an indispensable asset for the new financial services are listed below:

1. Improved Accuracy in Financial Decisions

AI-driven models examine large datasets ranging from transaction history to market trends that are undoubtedly beyond the capabilities of the human brain. This results in:

- Better risk profiling and loan approvals

- More precise investment recommendations

- Enhanced accuracy in credit scoring and forecasting

By using machine learning, fintechs continuously improve their models, which in turn leads to less human error in decision-making in financial matters.

2. Lower Operational Costs

AI is capable of automating such routine processes as KYC checks, document verification, fraud detection, and customer support. An example could be:

- Significant reductions in staffing costs

- Higher productivity with fewer resources

- Streamlined operations, especially for digital-only banks

3. Faster and Smarter Customer Service

With AI-powered chatbots and virtual assistants, fintech firms now offer:

- 24/7 real-time assistance

- Faster query resolution

- Personalised experiences based on user behaviour

Generative AI is also being employed in customer service to provide human-like responses to complicated customer problems.

4. Enhanced Fraud Prevention

AI is a perfect tool to spot fraud activity at lightning speed, thus uncovering the fraud before it escalates. It can be instrumental in:

- Watching transactions to detect any suspicious behaviour

- Applying behavioural analytics to discover new fraud patterns

- Equipping anti-money laundering (AML) systems

Therefore, AI can be considered as one of the major elements in building the digital security and trust of financial platforms.

5. Scalability and Automation

With the help of AI, fintech platforms can expand quickly without losing the quality of their services. Just to illustrate:

- Loan requests across thousands of users can be handled immediately without any delay

- Robo-advisors can cater to millions of users with personalised recommendations

- Compliance and risk checks are run in real time, without added staff

This level of automation ensures fintech companies remain agile as user bases grow.

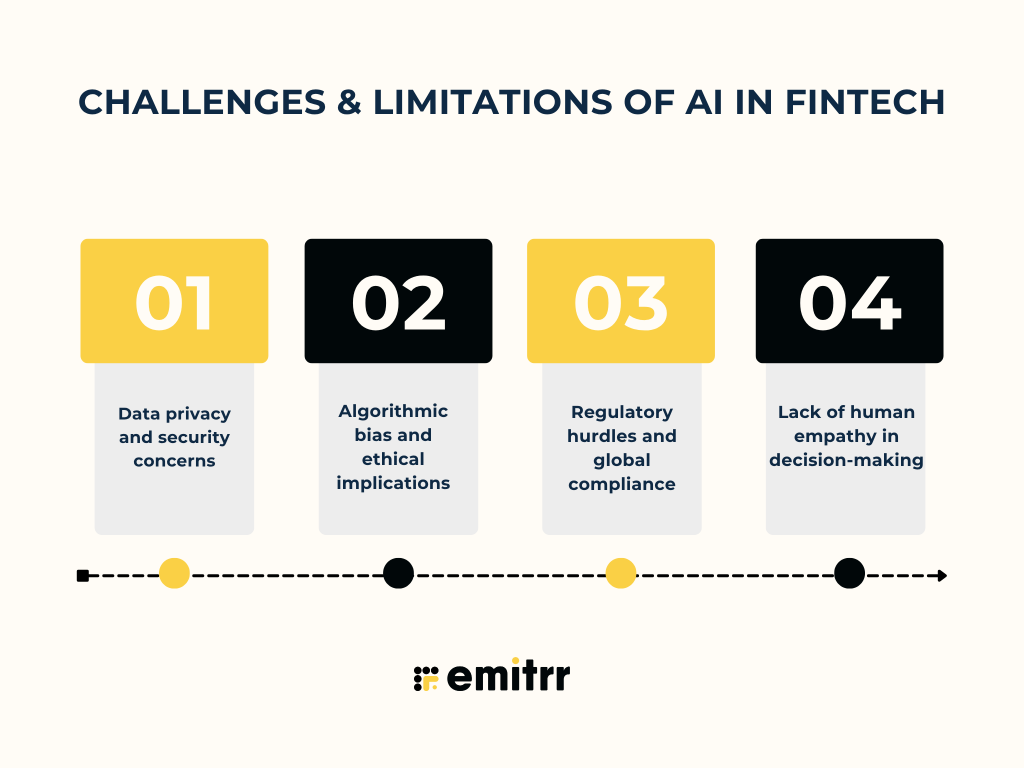

Challenges & Limitations of AI in Fintech

AI in fintech has a lot of promise; however, it also carries heavy challenges, which businesses should not underestimate. Privacy issues and ethical risks are some of the problems that the deployment of AI in financial services is not going to be an easy road.

Data privacy and security concerns

Fintech platforms are handling sensitive user data on a very large scale. This data can be, for example, transaction histories or ID documents. AI systems need this kind of data to be able to train and carry out real-time analysis, so it is very important to think about:

- Data breaches caused by insecure models or infrastructure

- Unauthorised access in automated workflows

- Identity theft due to fraud, privacy violation, or cyberattack

Ensuring strict data governance and encryption standards is the only way to gain the trust of customers.

Algorithmic bias and ethical implications

It should be noted that AI models can exacerbate the societal bias that existed before; they do so unconsciously. They are trained on incomplete or skewed datasets. In the financial world, this would be quite negative:

- Unfair credit scoring or loan denials

- Discrimination against certain demographics or geographies

- Inaccurate financial recommendations

Ethical AI development calls for various datasets, frequent audits, and full disclosure to ensure fairness and compliance.

Regulatory hurdles and global compliance

In many cases, AI systems are still in unknown terrain from a legal point of view, especially across borders.

- Evolving regulations like GDPR, CCPA, PSD2, and local banking laws

- Absence of coherent frameworks for AI decision-making

- Problems in providing an explanation and audit trails

The lack of regulation specifically for AI can lead to a situation where there is increased uncertainty and risk for fintech companies.

Lack of human empathy in decision-making

AI is good at performance, not at emotional intelligence. In cases such as:

- Debt collection

- Investment loss notifications

- Loan rejections

AI-powered communication without human supervision can worsen the customer experience if not handled well.

AI vs. Traditional Communication in Finance: The Shift Toward Smart, Scalable Systems

The financial industry has been going fast in the direction of making use of AI-based communication platforms instead of human-operated ones, which are wiser, faster, and more scalable. Traditional communication methods – that depended on manual input, static rule sets, and human agents – are now being supplanted by intelligent systems that can automate, personalise, and optimise interactions in real time.

1. Manual Decision-Making vs. Automated Intelligence

Human judgment is the deciding factor in legacy financial systems when it comes to issuing approvals, customer support escalations, or conducting fraud checks. On the other hand, AI models lean on present data and predictive analytics to make decisions faster and more accurately, thus saving processing time and avoiding errors.

2. Static Rules vs. Dynamic Models

By contrast with traditional platforms that work on fixed, hard-coded rules that are rarely updated, AI tools are dynamic in nature; they continue to grow by incorporating user behaviour, market conditions, and past data, thus allowing them to provide more context-aware and personalised communication.

3. Human Agents vs. AI-Powered Bots

The traditional banking system requires human agents, who have to be there even when only routine queries need to be solved, whereas AI-powered bots are capable of.

- Account inquiries

- Loan status updates

- Fraud alerts

- Investment recommendations

Hence, human agents are freer and available to handle complex customer needs and situations.

4. One-Size-Fits-All vs. Personalised Interactions

Traditional setups are still very dependent on mass emails or IVR (Interactive Voice Response) menus. On the other hand, AI makes use of customer data, which allows it to create personalized messages via the customers’ preferred channels. be it SMS, app notifications, WhatsApp or email, and deliver them at the right time.

5. Reactive Support vs. Proactive Engagement

Conventional systems are reactive; they help customers only when they make an initial contact. The use of AI enables fintech companies to have proactive customer service, such as detecting fraudulent transactions, suggesting financial products, or even sending notifications about payment of bills, in real time.

Table version:

| Aspect | Traditional Communication | AI-Driven Communication |

| Decision-Making | Manual, slow, often inconsistent | Automated, fast, data-driven |

| Rules & Logic | Static and pre-defined | Dynamic and continuously evolving |

| Customer Interaction | Handled entirely by humans | Managed by AI bots for routine and mid-complexity tasks |

| Personalization | Generic and limited | Context-aware & highly personalised |

| Response Time | Delayed; depends on human availability | Instant, available 24/7 |

| Scalability | Constrained by staffing | Infinitely scalable via AI & cloud infrastructure |

| Engagement Approach | Reactive; customer initiates | Proactive; the system anticipates & engages |

| Cost Efficiency | Higher costs due to labour and overhead | Lower cost via automation and reduced manual workloads |

Where Does AI Overtake Humans in Fintech?

AI has introduced the capabilities of financial institutions in a new dimension. Most of the time, AI performs excellently in tasks that require speed, scale, and accuracy. AI still outperforms human workers in these tasks:

1. Speed in Data Processing and Risk Scoring

AI models can go through large amounts of data, such as credit histories or real-time transactions, in a matter of seconds. This allows for faster loan approvals, KYC verification, and credit risk evaluation.

2. Accuracy in Pattern Detection (e.g., Fraud)

AI is good at recognising unexpected behaviour, such as abnormal expenditure or a wrong login. Utilising quicker and more accurate flagging, machine learning algorithms can prevent fraud than manual systems do.

3. 24/7 Customer Support Without Fatigue

AI-powered chatbots and virtual assistants handle queries around the clock, without delays, downtime, or human error, and provide consistent customer experiences across time zones.

4. Scalable Systems at Low Incremental Cost

The advantage of AI systems is that they can support millions of customers at the same time. In comparison to human support teams, they do not have to hire the same number of people as the increase in the customer base.

Where Do Humans Still Outperform AI in Fintech?

AI has won every aspect of the game; however, it is still behind when it comes to human capabilities, such as the ability to understand and make decisions based on emotions, emotional intelligence, and coming up with new ideas.

1. Relationship Management and High-Touch Advisory

For HNIs, institutional investors, or complex portfolio decisions, trust and empathy are still important. Human advisors provide personalised, goal-oriented assistance that AI is unable to mimic.

2. Ethical Judgment and Subjective Decision-Making

The parameters programmed by AI define its operations. However, humans can consider the situation, the purpose, and the moral aspects if the provided rules are insufficient or if there are conflicts, especially in debt recovery or investment strategy.

3. Strategic Finance and Innovation Thinking

Sectoral knowledge, risk-taking efforts, and innovative ideas are the pillars for successful long-range product development, sales prediction and market revolution, which is lacking in AI.

Why Businesses Need AI in Fintech Now

AI integration in the field of fintech has passed the stage of being merely a matter of choice and has become its characteristic feature. At the same time, customer expectations are changing, and threats are becoming more complicated. The businesses that are utilising AI get a critical advantage in speed, intelligence, and innovation, as well as they can adapt more quickly.

1. Competitive Pressure from Digital-First Banks

The neo-banks and the fintechs that are only working digitally have raised the bar higher for the customer experience, like instant service, smart personalisation, and seamless interfaces. Traditional banks must utilise AI-driven technologies or lose market share.

2. Rising Fraud Threats Demand Real-Time Detection

Financial fraud is getting more sophisticated rapidly and is progressing extremely fast. Monitoring based on machine learning constantly watches for unusual patterns, and integrating behavioural biometrics has the potential to quickly catch those trying to sneak in among the legitimate ones.

3. Customers Expect Speed and Personalisation

The on-demand economy is a major force that has changed people’s expectations beyond recognition. Technology powered by human intelligence makes it possible for instant decisions on the loan application, constant financial advice fitting one’s own, and an AI-based chatbot available around the clock, thus the user experience is completely transformed.

4. Explosion of Fintech-Focused AI Tools & APIs

The success of the AI initiatives is not limited to the largest tech companies. Several platforms, including Plaid, Zest AI, and Emitrr, are lowering the entry barrier to smart APIs and no-code tools, now even startups and SMBs can build AI-powered financial apps with very low cost.

5. Regulatory Compliance Through Automation

The rapid increase in international financial regulations necessitates more intelligent compliance. Tools powered by AI automate reporting, flag anomalies, and reduce legal risk, saving both time and money.

Generative AI in Fintech

1. Auto-Generated Financial Reports and Summaries

AI-driven generative models are capable of processing massive datasets, identifying key aspects, and creating quarterly earnings reports, financial summaries, and customer dashboards more quickly and accurately than manual reporting.

→ Professionals like wealth advisors, internal finance teams, and robo-advisory platforms rely on this technology.

2. Conversational AI for Onboarding and Support

The main LLMs offer chatbots new opportunities for carrying out various tasks conversationally; this kind of help leads to onboarding completion being done rapidly and error-free. Besides, they also lower customers’ waiting time, hence enhancing customer service quality.

→ Platforms such as Kasisto, Emitrr, and Klarna’s AI assistant.

3. AI-Generated Investment Insights and Portfolios

Generative AI can provide investors with a range of strategies to diversify their portfolios, produce presentations for client-facing, and write personalised newsletters under the market situation and the reader’s interests.

→ Most suitable for wealth managers, fintech advisors, and retail investors.

4. Compliance Document Drafting & Automation

In Regulatory Technology, generative AI is being employed in the writing of the initial parts of compliance reports, AML summaries, and audit documents, which ensures consistency while also speeding up the process of submitting the documents.

→ Used by financial institutions to comply with tight deadlines and reduce manual efforts.

Why Emitrr is the Ideal AI Communication Platform for Fintech Businesses

In the present highly competitive financial market, fintech organisations not only necessitate basic automation but also require an intelligent, secure, and scalable communication infrastructure. Emitrr is designed specifically to satisfy these requirements, providing an AI communication suite tailored for the financial industry.

Key Features That Set Emitrr Apart

AI Chatbots Trained on Financial Language

The Emitrr’s AI chatbots are designed in a way that they can be used in the financial and compliance fields without any issues. They can manage the customer queries, KYC workflows, and transactional interactions with great accuracy. This makes them very suitable for banking, lending, insurance, and investment platforms.

Seamless CRM Integration for Lead Management

Emitrr works with top CRMs to provide features like real-time lead capture, automated follow-ups, and funnel tracking. Emitrr makes the life of a communicator easier, no matter what the task is, be it client onboarding, advisory session scheduling, or lead nurturing.

Secure, Compliant, and Multilingual Support

Emitrr covers communication that observes the most critical data privacy frameworks such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard). On the other hand, its multilingual feature allows those financial institutions who are thinking of becoming globally present to do so without losing accuracy and respect for the various cultures.

Smart Workflows for Onboarding, Reminders, and Support

Emitrr is able to create no-code workflows that can be tailored to the requirements of each fintech in order to automate tasks like sending EMI reminders, onboarding messages, client engagement sequences, or helpdesk support, thus allowing the real-time responses and operational overhead.

AI Text Enhancement Features Now Available

Emitrr’s latest AI-powered writing tools are designed to elevate financial communication:

- Help Me Write: Generates whole messages or replies on-the-fly, for example, service updates, loan confirmations, or onboarding communications.

- Enhance:

- Make it Crisp: It polishes and shortens messages to make them clearer and professional..

- Make it Empathetic: It changes the tone if the content has to be emotionally sensitive or client-facing.

- Make it Crisp: It polishes and shortens messages to make them clearer and professional..

- Suggest a Reply: It gives examples of context-aware possible answers to new messages on autopilot – perfect for confirming document submissions, product queries, or investment follow-ups.

Note: These features are available only on Emitrr’s Professional Plans.

Why It Matters for Fintechs

Emitrr is more than just a chatbot vendor. It is a provider of sector-specific solutions in areas such as regulatory communication, multilingual support, response time optimisation, and lead leakage, making it a strategic partner for fintech businesses.

Future Trends in AI and Fintech

With the rise of financial technology, AI is rapidly going beyond just being an efficiency tool to a primary source of innovation and disruption in the industry. The following trends illustrate the anticipated developments of AI in fintech soon:

Embedded finance powered by AI

AI facilitates seamless financial transactions on non-financial platforms without any interruptions. For example, you may take out a loan in a shopping app or get insurance for your car on a vehicle platform. Beyond this, AI-based risk assessment, credit scoring, and decision-making work in the background, so embedded finance becomes smarter and smoother. This evolution is particularly evident in products like business credit cards with no credit check requirements, where alternative data and AI-driven assessments replace traditional credit checks.

AI-driven lending is a background job that carries out credit risk evaluation, scoring, and decision-making, thus making embedded finance more intelligent and frictionless.

Hyper-personalised financial services

Because of AI, the fintech companies are now able to dig deep into the customer behaviour and preferences on a detailed level. This will help them come up with laser-focused recommendations, customised investment plans, and credit products that change dynamically. This will increase the satisfaction of the customer and their conversion, simultaneously.

Decentralised AI models in blockchain-based finance

With the rapid expansion of decentralised finance, the use of decentralised AI models is becoming more and more popular. These models operate on cryptocurrency systems and increase transparency by eliminating the need for a central data administrator, as well as trusting AI that makes the decisions for lending, asset management, and insurance.

AI-based ESG investment tools

With the increasing interest in sustainability, financial technology companies have resorted to artificial intelligence (AI) to evaluate environmental, social, and governance (ESG) factors. The tools search through corporate disclosures, sentiment in the news, and sustainability indicators to provide investors with a more informed decision about socially responsible and impact investment.

Multilingual AI for real-time global banking applications

To serve users from different parts of the world, fintech firms employ AI-based language models that offer real-time assistance in various languages. This comprises AI robots for chatting, translating documents, and even giving localised financial advice, thus enabling inclusiveness and raising customer engagement globally.

FAQs

AI utilised in the banking sector and fintech has the aim of automating the operations, discovering fraud, customer experience personalisation, and improving decision-making. The most common applications of AI in banking and fintech include:

Chatbots for 24/7 customer service

Credit scoring using alternative data

Fraud detection through real-time anomaly monitoring

Robo-advisory for investment planning

Document processing using NLP and OCR

These financial applications allow for lower costs, raise productivity, and ensure the highest precision in financial services.

AI definitely cannot be a complete substitute for financial advisors; however, it still supports their job. AI and Robo-advisors are the perfect match that can take over:

Portfolio suggestions

Risk analysis

Tax-loss harvesting

Some of the most prominent fintech companies that employ the power of AI are:

Upstart > AI-based credit scoring and loan approvals

Zest AI > Machine learning for fair, data-driven underwriting

Kensho > AI-powered financial analytics (S&P Global)

Kasisto > Conversational AI for digital banking

Plaid > Real-time financial data APIs with AI insights

Affirm > Risk modelling for AI in Buy Now, Pay Later (BNPL) services.

Emitrr > A communication and automation platform powered by AI, designed for financial service providers too.

Generative AI might be considered safe for financial data when carried out responsibly:

Implementing LLMs at an enterprise level with data encryption

Utilising role-based access control to secure confidential information

Not disclosing sensitive customer data to public models

Following regulations such as GDPR, PCI DSS, and FFIEC guidelines

AI is changing the face of the finance sector to a great extent in the following fields:

Fraud Prevention: AI models detect abnormal transactions in milliseconds.

Loan Underwriting: AI evaluates borrower risk using non-traditional data like social media or mobile usage.

Automated Wealth Management: Robo-advisors offer real-time investment recommendations.

Chatbots and Voice AI: Used for onboarding, KYC, and customer support.

RegTech: AI helps banks comply with regulations by scanning reports and monitoring suspicious activities.

Conclusion

Artificial Intelligence has left its mark on the financial technology sector, and it has rapidly become a driving force that carries the industry on its wings of innovation, efficiency, and customer-centricity throughout the whole financial landscape. AI is a major player that has and is being used for fraud detection, underwriting, and generative tools as well as for hyper-personalised banking, and it is.

For fintech companies that decide to be proactive, using AI is not an option anymore; it is a necessity if they want to remain competitive. Investing in growth that is made possible by AI, being able to anticipate customer needs, and complying with regulations can now all be handled by high-grade AI solutions.

Emitrr shares the same vision with this revolution in technology, offering AI communication tools that are secure, compliant, and customizable for fintech users. This moment is the most appropriate for stepping up. Join your AI journey with Emitrr and become a game-changer in finance.

4.9 (400+

reviews)

4.9 (400+

reviews)