Introduction

Are you tired of traditional landlines and looking for a modern solution for your insurance company? We’ve got you covered with cutting-edge VoIP services designed specifically for the insurance industry, making everyday operations smoother and more efficient. Do you know how VoIP Phone Systems for Insurance agencies work?

VoIP (Voice over Internet Protocol) for insurance allows agencies to handle phone calls over the Internet instead of traditional phone lines. A VoIP phone system for insurance makes managing client inquiries, claims, and policy updates easier and more efficient. With features like call routing, voicemail, call queuing and call forwarding, insurance agents can stay connected with clients anytime, anywhere.

Why is it necessary? VoIP streamlines communication, reduces costs, and improves customer service. According to EnterpriseAppstoday, 67% of insurance companies using VoIP for insurance companies reported improved client satisfaction due to faster response times and smoother communication.

In a competitive market, a VoIP phone system for insurance helps insurance agencies stay efficient and responsive, making it an essential tool for success.

In this blog, we will explain how VoIP is a game-changer for insurance companies.

How VoIP Transforms Client Service for Insurance Companies?

Business phone services for insurance agencies are changing the way insurance companies interact with their clients by making communication easier, cheaper, and more secure. Here’s how:

Remote Work Capability

With VoIP Phone Systems for Insurance, agents can work from anywhere in the world. Whether they’re at home or on the go, they can still answer calls and messages without being tied to an office. This keeps insurance agency answering services running smoothly, even when agents aren’t physically in the office and are working remotely.

Cost Savings

An answering service for insurance agents helps insurance agents save money by cutting down on the cost of traditional phone lines and expensive equipment sets. Instead, when it comes to an auto-attendant for insurance agencies, all communication happens over the Internet, making it a much cheaper phone system for insurance agencies without sacrificing quality.

Data Security

Data security is crucial for insurance companies. VoIP Phone Systems for Insurance systems have built-in security features to protect sensitive client information, ensuring that everything from phone calls to messages is safe from breaches. This is especially important for insurance agents handling confidential data and answering services.

Mobile Access

Business phone services for insurance agencies allow agents to access calls and messages directly on their mobile phones. This means agents can stay connected to clients even when they’re out of the office, making VoIP phone systems for Insurance agents a flexible and convenient solution for improving client service.

CRM Integration

An answering service for insurance agents often integrates with CRM tools, helping agents manage client data and communication in one place. This makes it easier for insurance agency answering services to keep track of client needs and provide a more personalized service. A VoIP for insurance companies that works with CRM tools becomes a powerful phone system for insurance agencies looking to improve their workflow.

Faster Claims Processing

With VoIP Phone Systems for Insurance agencies, claims get processed much quicker. Instead of clients waiting, calls go directly to the right agent, speeding up the response. VoIP for insurance agencies can also record calls to double-check details and easily collaborate with teammates in real time. Plus, since Business phone services for insurance agencies work anywhere, agents can handle claims on the go, making the whole process faster and more convenient for everyone.

Reliable Communication During Emergencies

During emergencies, VoIP Phone Systems for Insurance agents keep the lines open. Unlike traditional phones, an answering service for insurance agents reroutes calls if something goes wrong, ensuring that the insurance agency answering service stays reachable even during outages. This makes communication very easy and reliable.

Smart Call Routing for Better Service

VoIP for insurance companies uses smart technology to route calls to the right agent based on client needs. This ensures that answering services for insurance agents handle each call efficiently, offering faster and more personalized support.

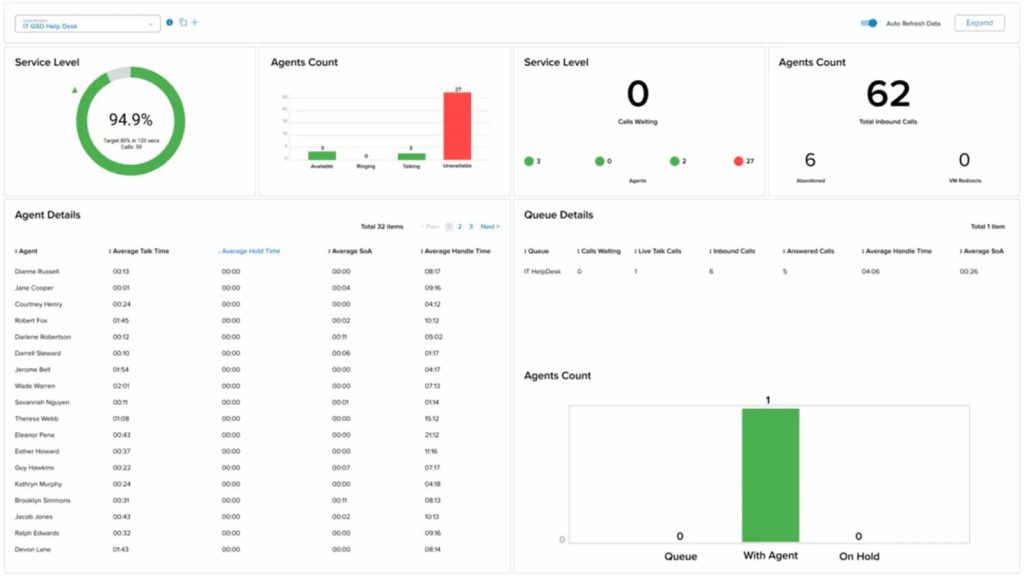

Real-Time Call Tracking and Insights

Business phone services for insurance agencies allow insurance companies to track calls in real time, providing helpful insights into client interactions. This feature offered by VoIP for insurance agencies helps agents improve their service and follow up with clients more effectively, making it an ideal phone system for insurance agencies.

Easy Collaboration Across Multiple Offices and Remote Teams

Business phone services for insurance agencies make collaboration easy, even when agents are spread across multiple locations or working remotely. With conference calling and messaging features, agents can stay connected and work together seamlessly, which is vital for insurance agents managing several offices.

Top VoIP Phone Systems for Insurance- A Quick Comparison

| Software | Value for Money | Features | Customer Support | Ease of Use |

| Emitrr | 4.9/5 | 4.8/5 | 5.0/5 | 4.9/5 |

| Ooma | 4.8/5 | 4.7/5 | 4.7/5 | 4.6/5 |

| RingCentral | 4.7/5 | 4.2/5 | 4.3/5 | 4.7/5 |

| Vonage | 4.0/5 | 4.0/5 | 4.2/5 | 4.0/5 |

| Grasshopper | 4.3/5 | 4.2/5 | 4.4/5 | 4.4/5 |

Key Highlights:

- Here, Emitrr is the highest-rated software solution for VoIP Phone Systems for Insurance companies as it is rated highest in terms of value for money, features, ease of use, and commendable customer satisfaction.

- Following Emitrr, Ooma and RingCentral have decent ratings and good value-for-money options.

- Vonage and Grasshopper, have the least ratings amongst all.

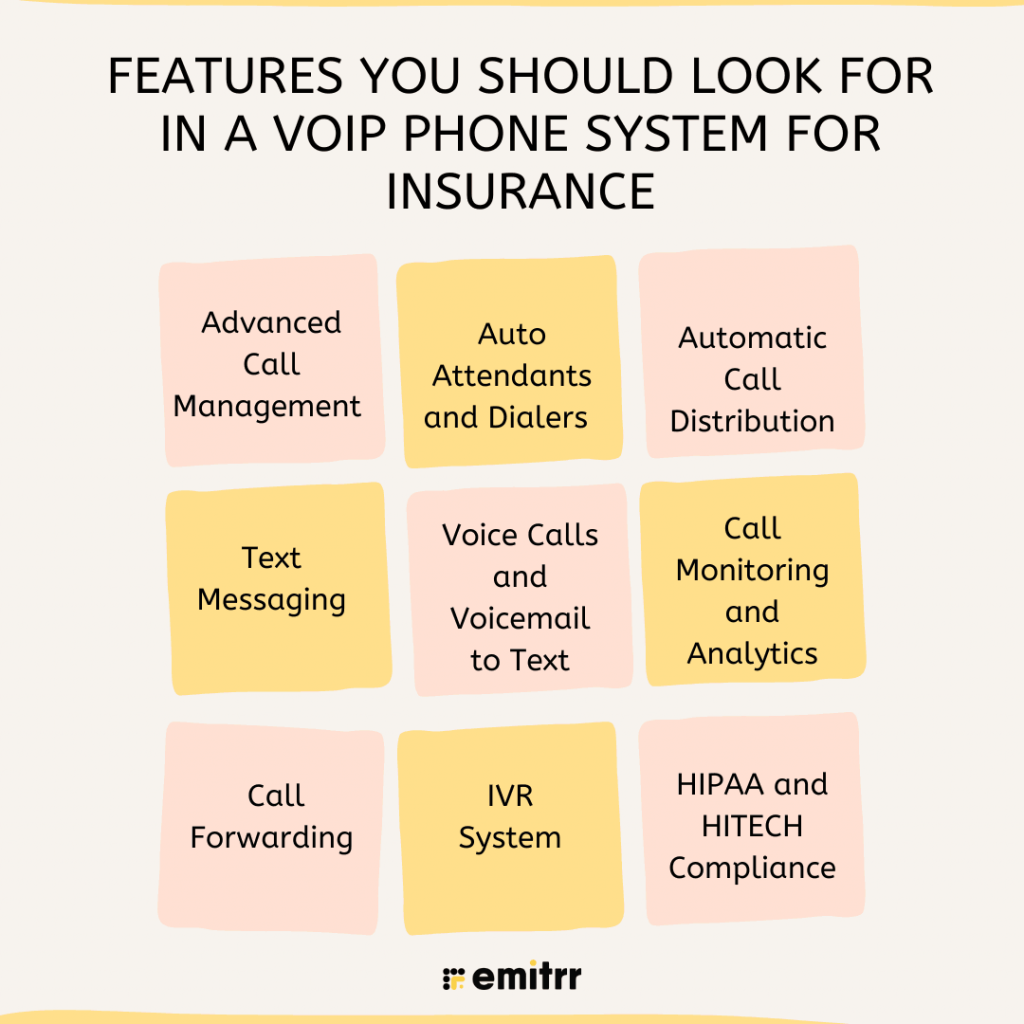

Features You Should Look For In a VoIP Phone System For Insurance

Here are the features that you should look at while choosing your best VoIP insurance solution:

Advanced Call Management

When picking VoIP Phone Systems for Insurance agencies, advanced call management is key. It helps route calls quickly and efficiently, so agents can handle them without delays. This feature makes managing a high volume of calls easier and ensures that no customer is left waiting.

Auto Attendants and Dialers

Auto attendants greet callers and guide them to the right department without needing a live person to answer the phone. This feature in insurance agency answering services saves time and improves caller experience. Automated dialers also help by speeding up the process for outgoing calls, giving agents more time to focus on customer needs.

Automatic Call Distribution

Automatic call distribution ensures incoming calls are sent to the right agent or team. This is important for a smooth customer experience and reduces wait times. A solid VoIP Phone System for Insurance agents will always have this feature to keep things running smoothly.

Text Messaging

Text messaging is a valuable feature in VoIP Phone Systems for Insurance agencies. An answering service for insurance agents allows agents to send quick updates or reminders to clients without needing to make a call. This keeps communication simple and efficient, especially for clients who prefer texting over calls.

Voice Calls and Voicemail to Text

Voice calls are a basic feature, but voicemail-to-text takes it up a notch. This feature, offered by business phone services for insurance agencies, allows agents to read voicemails as text, which is faster and more convenient. It’s an easy way to stay on top of missed calls in any answering service for insurance agents.

See how you can automatically convert voicemails to text using Emitrr:

Call Monitoring and Analytics

Call monitoring and analytics provide insights into how well calls are handled. Supervisors can use this to check agent performance and identify areas for improvement. It’s a useful feature for optimizing the phone system for insurance agencies.

Call Forwarding

Call forwarding ensures that agents never miss important client calls, even when they’re away from their desks. This feature is essential in any VoIP insurance system to keep communication flowing smoothly.

IVR System

An IVR system lets callers interact with the insurance agency answering service using voice prompts, saving agents time by answering basic questions automatically. It’s a great way to boost efficiency while keeping customers happy.

HIPAA and HITECH Compliance

Compliance with HIPAA and HITECH is critical for any VoIP Phone Systems for Insurance agencies. It ensures that all communication is secure and client information stays protected, a top priority in the insurance industry.

Want to learn how a VoIP system can transform your business communication? Watch this YouTube video to explore all the benefits!

Detailed Analysis of Top VoIP Phone Systems for Insurance

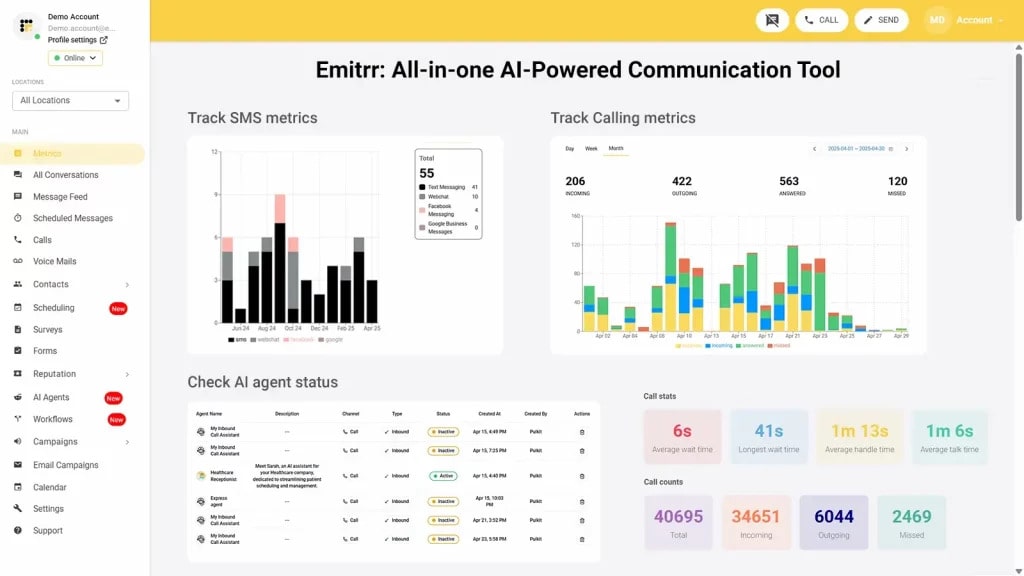

1. Emitrr

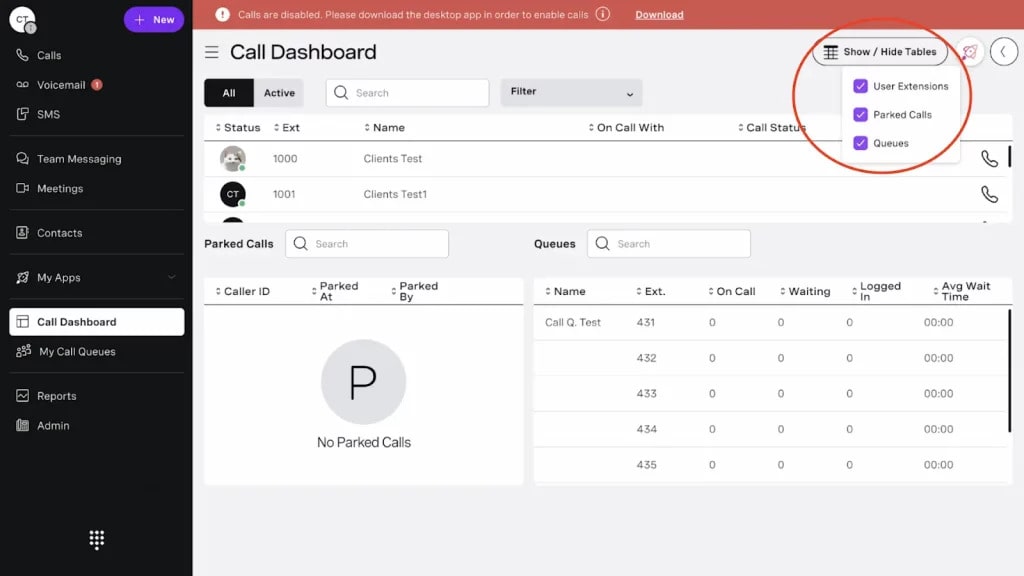

Emitrr is an all-in-one communication platform, serving as the ideal VoIP assistant for insurance agencies managing client communication. This answering service for insurance agents simplifies everything by bringing calls, texts, and emails onto one easy-to-use platform. Instead of coping with different systems, your team can handle everything from client inquiries to claims processing in one place.

Features of Emitrr

- Integrates with 1000+ local business CRMs – This VoIP service for insurance agencies connects seamlessly with popular CRMs to streamline operations.

- Unified communication system – Brings calls, texts, and messages into one platform for easy management.

- Multi-location management – VoIP service for insurance agencies lets businesses handle communication across multiple branches from a single dashboard.

- Call routing, voice calls, call forwarding, and call transfer – This VoIP provider ensures customers always reach the right agent without delays.

- Caller ID and IVR – Identifies callers instantly and guides them with an interactive menu for faster resolution.

- Voicemails and customizable on-hold music – This VoIP provider keeps communication professional with personalized messages and hold tunes.

- Auto-attendants and call encryption (TCPA compliant) – This answering service for insurance agents also protects data while giving callers an automated yet secure experience.

Pros of Emitrr

- High-quality customer support – Provides quick, reliable assistance whenever businesses need help.

- Easy setup and integration – Simple to launch and works smoothly with existing tools.

- Automation for efficiency – Reduces manual work by handling repetitive communication tasks.

Cons of Emitrr

- More features to be added soon

Ratings of Emitrr

- Capterra: 4.8/5

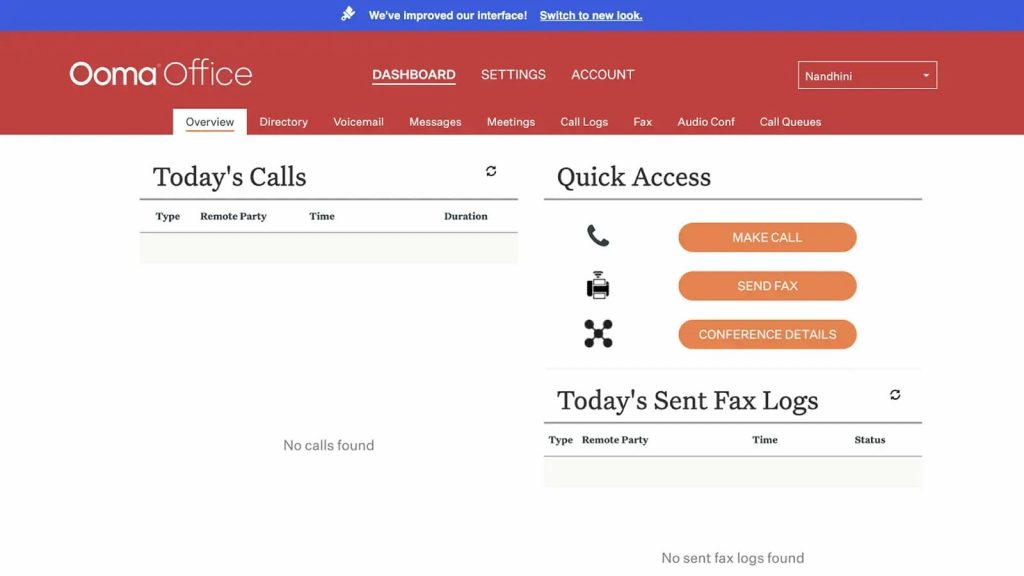

2. Ooma

Ooma is a budget-friendly VoIP provider that is perfect for small and medium-sized insurance agencies. This answering service for insurance agents is known for delivering affordable, reliable communication solutions, emphasizing ease of use for handling client claims and policy inquiries. Let’s have a look at the features, pros, cons, and pricing of this phone system for insurance agency:

Features of Ooma

- Mobile app for remote work – Enables agents to make and receive calls from anywhere using their smartphones.

- Virtual receptionist for automated call handling – This business phone service for insurance agency and agents answers and directs calls without needing a live operator.

- Call blocking, forwarding, and conference calling – This business phone service for insurance Agencies and agents offers flexibility to manage calls efficiently and collaborate easily.

Pros of Ooma

- User-friendly interface – This business phone service for insurance agency and agents has a simple design that makes it easy for teams to learn and use.

- Affordable plans for small insurance agencies – Budget-friendly options tailored for smaller businesses.

- Reliable customer service – This answering service for insurance agents provides consistent support whenever assistance is needed.

Cons of Ooma

- Limited third-party integrations – Doesn’t connect widely with external software tools.

- Basic features compared to competitors – Lacks advanced options offered by some other VoIP providers.

Ratings of Ooma

- Capterra: 4.5/5

3. RingCentral

RingCentral is a leading cloud-based communication platform designed for businesses of all sizes, including large insurance firms. This VoIP service for insurance agencies offers a comprehensive feature set that enables seamless team communication and collaboration, especially useful for multi-location insurance agencies. Let’s have a quick look at this VoIP service for insurance agencies:

Features of RingCentral

- 300+ integrations with CRMs and collaboration tools – This VoIP phone system for insurance companies connects easily with popular business apps to streamline workflows.

- Unified communications across voice, video, and messaging – Combines multiple communication channels into one platform for seamless collaboration.

Pros of RingCentral

- Comprehensive features for larger insurance teams – This VoIP phone system for insurance companies offers advanced tools that support complex team needs.

- Scalable for agencies of all sizes – Adapts to growing businesses, from small agencies to large enterprises.

- Strong integration with productivity tools – Works smoothly with apps like Microsoft 365, Google Workspace, and others.

Cons of RingCentral

- High costs for premium features – Advanced capabilities for this VoIP phone system for insurance companies come with a higher price tag.

- Customer support issues, including slow response times – Users often face delays in getting timely assistance with this VoIP phone system for insurance companies.

Ratings of RingCentral

- G2: 4.2/5

4. Vonage

Vonage is a well-established VoIP for insurance companies, offering customizable solutions for insurance companies of all sizes, from small agencies to large enterprises. Its focus is on flexibility and scalability to accommodate growing client needs and claims processing. Here is a quick look at this VoIP for Insurance companies:

Features of Vonage

- Advanced reporting and analytics – This VoIP phone system for insurance companies tracks and evaluates client interactions to improve performance.

- Video conferencing for internal and client meetings – Supports seamless virtual meetings for both teams and policyholders.

- Call encryption – Protects sensitive conversations with secure communication protocols.

Pros of Vonage

- Highly customizable for large insurance firms – This VoIP phone system for insurance companies offers flexible configurations to match complex business needs.

- Ideal for businesses needing advanced communication APIs – This insurance agency phone solutions provides developer-friendly APIs for tailored communication solutions.

- Scalable solution for growing agencies – Expands easily as the agency grows without compromising performance.

Cons of Vonage

- Higher costs for small insurance agencies – Pricing may not be budget-friendly for smaller firms when opting for insurance agency phone solutions.

- Expensive for teams needing advanced features – Costs rise significantly when using premium functionalities of this insurance agency phone solutions.

Ratings of Vonage

- G2: 4.3/5

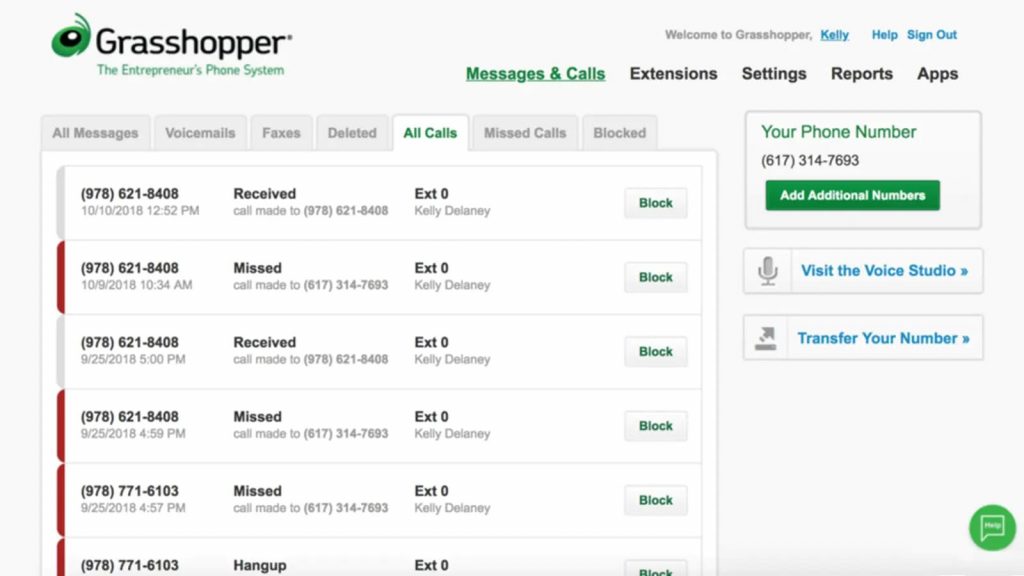

5. Grasshopper

Grasshopper is a simple, effective VoIP solution tailored for small insurance agencies that need essential communication features. This phone system for insurance agency helps manage client calls, voicemails, and other interactions efficiently, making it easier for teams to handle day-to-day operations. Let’s have a quick look at this VoIP for Insurance companies:

Features of Grasshopper

- Voicemail-to-email transcription – This insurance agency phone solutions converts voicemails into text and sends them directly to email for quick review.

- Call forwarding and call routing – Directs calls to the right person or device without missing clients.

- Customizable greetings and hold music – This insurance agency phone solutions lets agencies create a professional call experience with personalized messages.

- Mobile app for on-the-go call management – This Secure VoIP for insurance professionals allows agents to handle business calls from anywhere using their phones.

Pros of Grasshopper

- Easy to use with a simple setup process – This Secure VoIP for insurance professionals quick to install and beginner-friendly for small teams.

- Affordable plans suited for small insurance agencies – Budget-conscious pricing of this Secure VoIP for insurance professionals designed for smaller businesses.

Cons of Grasshopper

- Lacks advanced features found in larger VoIP systems – Missing some high-end tools that bigger providers offer.

- Limited third-party integrations – Doesn’t connect with many external platforms.

- Not ideal for larger agencies with complex needs – Better suited for small-scale operations than big enterprises.

Ratings of Grasshopper

- G2: 4.0/5

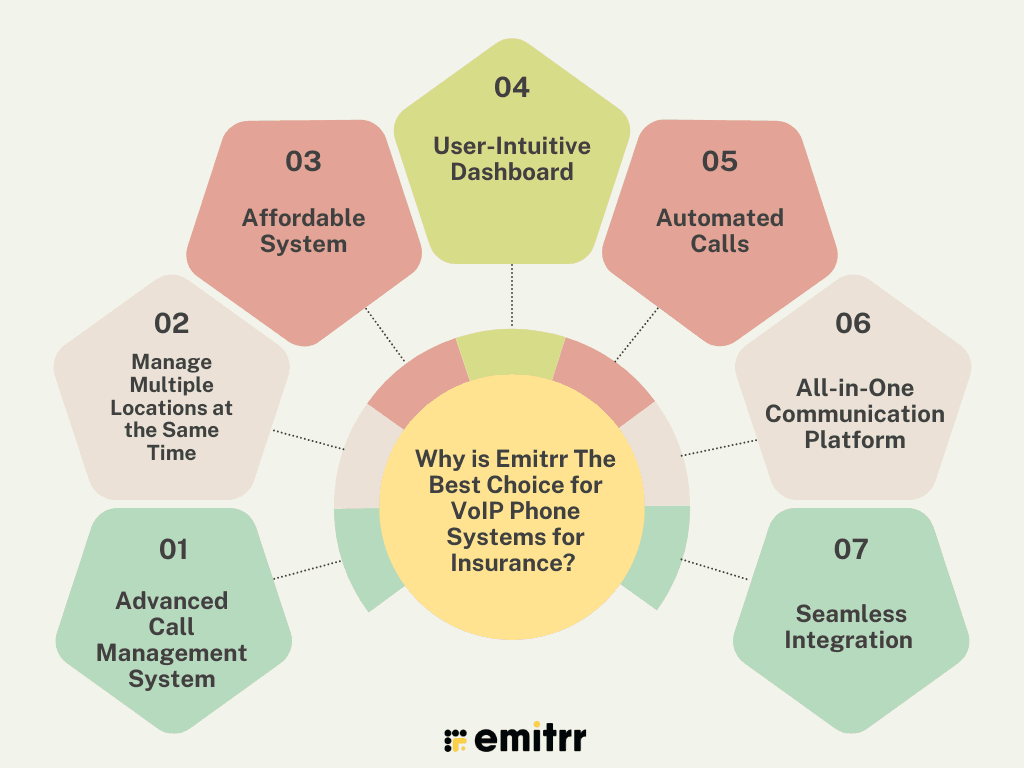

Why is Emitrr The Best Choice for VoIP Phone Systems for Insurance?

Emitrr stands out as the best choice for VoIP Phone Systems for Insurance service software due to its robust features and affordability. Here’s why:

Advanced Call Management System

Emitrr offers an advanced call management system that allows insurance agency answering services to handle high call volumes smoothly. The VoIP for insurance companies is designed for easy routing, ensuring that calls reach the right agent quickly, improving overall customer experience.

Manage Multiple Locations at the Same Time

With the ability to manage multiple locations simultaneously, Emitrr, the best VoIP for insurance agencies, is perfect for insurance agents handling multiple offices or branches. This capability ensures seamless communication across various offices, making it a top choice for VoIP Phone Systems for Insurance agents.

Affordable System

Unlike many providers, Emitrr, the best VoIP for insurance agencies, is affordable, making it ideal for agencies looking to implement a full-featured phone system for insurance without breaking the bank. Despite its low cost, it does not compromise on quality or features, making it a reliable option for agencies of all sizes.

User-Intuitive Dashboard

Emitrr provides a user-friendly interface that simplifies managing calls and messages. Insurance agents can easily monitor and track all communications through its dashboard, making it an efficient phone system for insurance agencies. This ease of use offered by VoIP for insurance agencies reduces the learning curve, allowing agents to focus on clients.

Automated Calls

Automation is a key feature of Emitrr. This VoIP for insurance agencies allows answering services for insurance agents to send automated calls for reminders, updates, and follow-ups. This saves time and ensures that clients are always informed, without agents needing to make each call manually.

All-in-One Communication Platform

Emitrr is more than just a VoIP Phone System for insurance system—it’s an all-in-one platform that integrates voice, SMS, and email. This combination is vital for insurance agencies, offering multiple communication channels within a single platform. Whether it’s responding to inquiries or sending out policy updates with VoIP for insurance agencies, agents have all the tools at their fingertips.

Seamless Integration

Emitrr’s Seamless Integration lets insurance agencies easily connect with over 1,000 business CRMs, ensuring all client data is accessible in one place. This VoIP for insurance agencies streamlines operations by syncing customer interactions like calls, emails, and texts with existing systems, reducing manual work and improving accuracy. Insurance teams can manage claims and client communications effortlessly without switching between different platforms.

Frequently Asked Questions

VoIP enhances efficiency by routing calls automatically, tracking conversations, and allowing agents to access claim data quickly, reducing response times.

VoIP significantly reduces communication costs for insurance agencies by using the Internet instead of traditional landlines, allowing for more affordable and flexible plans. Providers like Emitrr offer features such as call forwarding, voicemail-to-email, and auto-attendants, which help insurance companies manage customer inquiries and claims without the high costs associated with traditional phone systems.

VoIP uses encryption, secure logins, and compliance measures like HIPAA to safeguard client data. Companies like Emitrr are compliant with TCPA and HIPPA to ensure there is no data breach and provide solid VoIP Phone Systems for Insurance features.

Look for call management, CRM integration, voicemail-to-text, and robust security to improve communication and protect client data. Emitrr, here provides all the features necessary to run smooth insurance corporations using VoIP Phone Systems for Insurance services.

Yes. VoIP platforms like Emitrr easily integrate with CRMs and insurance management tools. This gives agents instant access to client records during calls and helps them track every interaction more efficiently.

Most agencies save significantly by moving to VoIP provider like Emitrr. It eliminates bulky hardware, offers affordable call rates including international calls and lets you scale the system as your agency grows.

Yes. VoIP like Emitrr supports remote and hybrid work setups. Agents can make or receive calls through mobile apps, laptops, or desk phones, ensuring uninterrupted communication no matter where they’re located.

Conclusion

In a nutshell, VoIP Phone Systems for Insurance is a 360-degree game changer for insurance companies. Emitrr here provides all the necessary features needed to run a strong corporation on VoIP features like advanced call management, Text messaging, an all-in-one communication system, automated calls and more. Book a demo today to learn more about VoIP Phone Systems for Insurance services and how it can help you grow your business.

4.9 (400+

reviews)

4.9 (400+

reviews)