Introduction to Chatbot for Financial Services

The financial services industry is evolving rapidly, with AI chatbots in banking playing a crucial role in transforming customer interactions. From banking and insurance to fintech, these intelligent virtual assistants are streamlining operations, enhancing customer engagement, and improving efficiency.

With rising customer expectations, financial organizations are leveraging chatbots like Emitrr to provide 24/7 support, instant query resolution, and seamless self-service experiences. Banks utilize them for loan approvals and KYC verification, insurance firms rely on them for policy recommendations and claims processing, and fintech platforms integrate them to enable secure transactions and investment management.

By the end of this guide, you’ll be able to choose the best AI chatbot for banking and will know how you can use them to enhance customer engagement, security, and operational efficiency in your bank.

What is a Finance AI Chatbot?

Finance AI chatbots are virtual banking assistants designed specifically for banking, insurance, and investment firms to automate customer interactions, enhance service efficiency, and improve security. These banking chatbots leverage artificial intelligence (AI), natural language processing (NLP), and machine learning (ML) to understand user queries, provide real-time responses, and assist with financial transaction automation.

How Do Fintech Chatbots Work?

Financial or fintech chatbots work through the combination of NLP, machine learning, and automation to understand and reply to user questions. Here’s how they do it:

- Natural Language Processing (NLP): Enables fintech chatbots to understand, interpret, and respond to customer queries in a human-like manner.

- Machine Learning (ML): Enables finance chatbots to learn from previous interactions and enhance their replies with time.

- Automation: Assists in automating repetitive tasks like account inquiries, transaction processing, fraud detection, and compliance verification.

- Integration with Financial Systems: Assists in automating repetitive tasks like account inquiries, transaction processing, fraud detection, and compliance verification.

With their capacity to handle large volumes of data, maintain compliance, and offer customized AI solutions, chatbots in financial services have become a vital tool. Financial firms managing multiple product lines or service tiers often pair these tools with product portfolio management software to keep development priorities, compliance requirements, and launch timelines organized in one place.

Use Cases of AI Chatbots in Financial Services

Chatbot in financial services have emerged as a game-changer for banks, insurance providers, and fintech platforms. Chatbots are used in finance for streamlining processes, enhancing security, and improving customer experience in different financial operations. The following are the major use cases:

Customer Support & Query Resolution

Chatbots offer instant, 24/7 support for account balance, transaction history, loan eligibility, and policy information-related queries. They minimize waiting time and increase customer satisfaction.

Fraud Detection & Security Alerts

Chatbot in financial services can identify anomalies in transaction patterns and user behavior and send customers real-time fraud alerts. They also help report and block suspicious transactions.

Loan Processing & Eligibility Checks

Chatbots make loan applications easier by checking documents, determining eligibility, and walking users through approvals. They connect with credit scoring systems to deliver quicker loan decisions.

KYC (Know Your Customer) Automation

Financial institutions implement an AI financial assistant for the collection, verification, and processing of KYC documents with fewer manual efforts. They not only maintain AI and regulatory compliance in finance but also make the account opening and verification faster.

Investment & Wealth Management Advisory

Chatbots also function as digital financial advisors that provide investment prospect analysis, risk assessment, and portfolio management using live market trend insights.

Insurance Claims Processing & Policy Management

Insurance companies employ a virtual assistant for banking, for filing claims, monitoring claim status, and suggesting appropriate policies from customer profiles. This saves paper and increases efficiency.

Payment Reminders & Bill Management

Chatbots assist users in setting up bill payments, making transactions and sending reminders, ensuring timely settlement of utilities, credit cards, and EMIs.

Account & Card Management

Customers can order new cards, freeze/unfreeze an account, report lost cards, or change personal information using a chatbot in financial services, making banking more accessible.

AI and Regulatory Compliance in Finance

Chatbots help financial institutions maintain compliance with local and international regulations through real-time advisory services on anti-money laundering (AML) and other compliance procedures.

Personalized Financial Planning

With AI-backed data, chatbots scan spendable amounts, salaries, and goals to deliver savings suggestions, budgeting guidance, and custom finances.

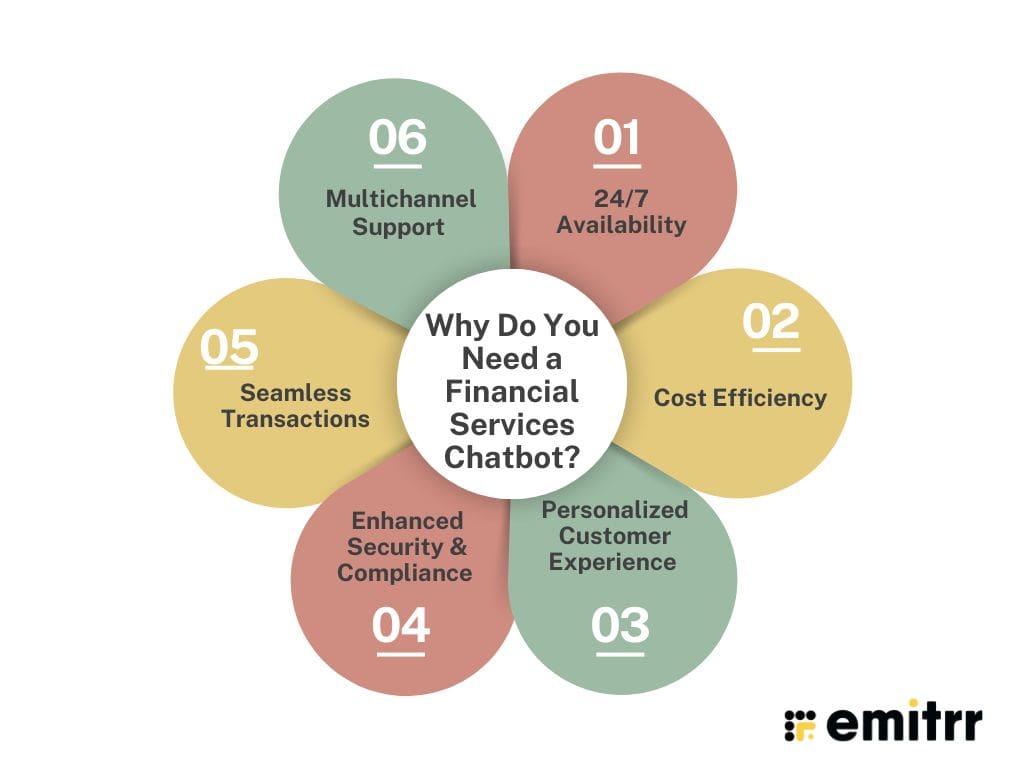

Benefits of AI Chatbot in Financial Services

Implementing chatbots in financial services offers numerous benefits that enhance both operational efficiency and customer satisfaction. Here’s why your financial institution should consider integrating a chatbot:

24/7 Virtual Assistant for Banking

Round-the-clock customer support automation in banking via a virtual assistant ensures clients have access to help at all times, regardless of regular business hours. This ongoing accessibility translates to customer satisfaction and loyalty.

Cost Efficiency

Automating repetitive tasks and questions through an AI financial assistant minimizes human agents’ workload, resulting in huge cost benefits. This saves time, enabling employees to deal with more complicated cases and ensuring optimal resource utilization.

Personalized Customer Experience

Smart chatbots, using developments in AI such as generative AI, use artificial intelligence to track user behavior and tastes, giving customized financial suggestions and product tips. This is personalized to bring the overall customer experience to life.

Enhanced Security & Compliance

Chatbots can be used to track transactions for any malicious behavior and make regulatory compliance like KYC/AML and GDPR easy by assisting customers with safe procedures. For instance, AI is being used in some financial organizations to detect fraud and support customer services, summarizing automatically in order to ensure the quality of human interactions. Chatbots also support improved data security and comply with strict data privacy regulations. These safeguards are increasingly integrated into fintech software development to meet regulatory and consumer expectations. At the same time, many banks and fintech firms are investing in AI chatbot development to deliver personalized support, ensure compliance, and improve customer engagement.

Seamless Transactions

With the capability of processing transactions like fund transfers, bill payments, and loan applications, chatbots simplify processes, making banking easy for customers. This automation results in quicker and error-free transactions.

Multichannel Support

Conversational AI in finance can be implemented across multiple platforms like websites, mobile applications, and social media, offering uniform support and a similar customer experience no matter what channel is used.

In the changing world of finance, integrating AI financial assistant into your service offerings not only keeps pace with the changing needs of digitally savvy customers but also places your institution at the cutting edge of innovation, stimulating growth and competitiveness. In the future, these advantages will become even more acute as AI technology evolves.

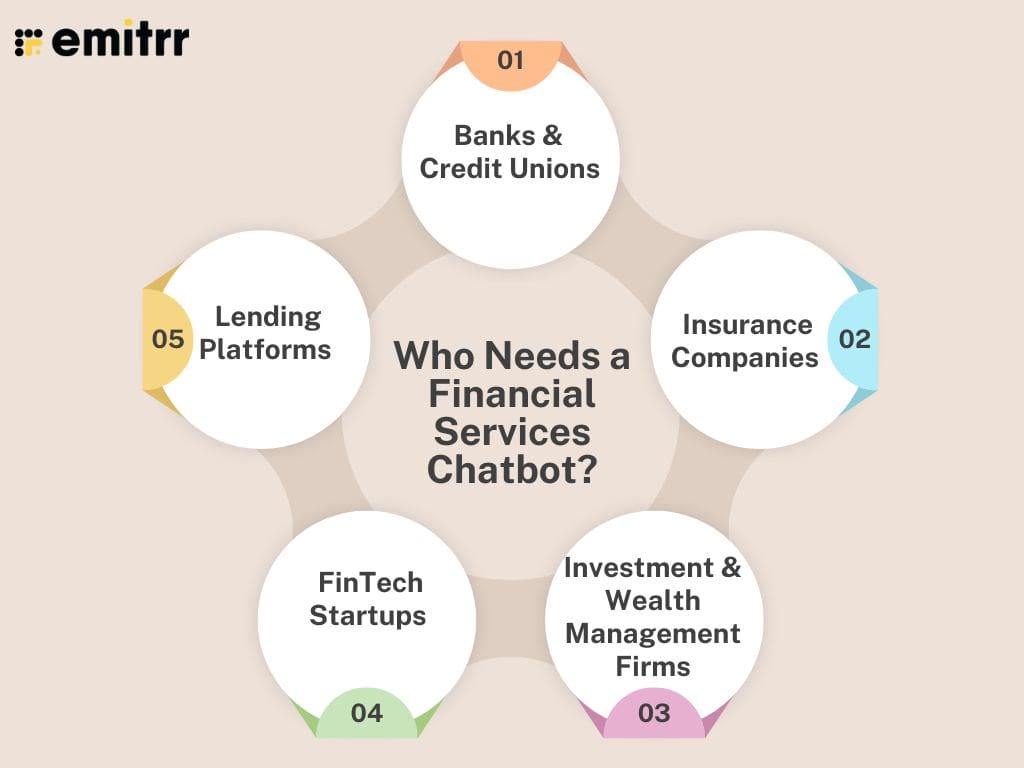

Who Needs a Financial Services Chatbot?

Incorporating AI-driven chatbots has become crucial in many segments of the financial sector, augmenting customer interactions, automating processes, and maintaining compliance. This is how various financial organizations can gain advantages:

Banks & Credit Unions

Banks and credit unions use chatbots to offer 24/7 customer support automation in banking, to manage mundane inquiries, and support transactions, thus enhancing customer satisfaction and operational effectiveness. Chatbots also assist in maintaining regulatory compliance, e.g., KYC follow stringent data privacy measures

Insurance Companies

Insurance companies use chatbots to automate processes like policy queries, claims handling, and customer service, cutting down on response times and operational expenses. The chatbots also guarantee that sensitive customer information is treated with maximum security and in accordance with applicable regulations.

Investment & Wealth Management Firms

Investment firms and wealth management advisors use chatbots to provide clients with real-time market insights, portfolio updates, and personalized investment recommendations, enhancing client engagement and service personalization. Chatbots also assist with compliance regarding investment advice and handle sensitive financial data securely.

FinTech Startups

FinTech companies utilize virtual assistants for banking to provide innovative financial products such as personalized micro-investing guidance, automated budget management, and streamlined customer onboarding, ensuring a smooth user experience and standing out in a crowded marketplace. The chatbots also comply with data protection laws and secure processing of user data.

Lending Platforms

Lending platforms incorporate chatbots to simplify loan application procedures, determine eligibility, and deliver real-time support, leading to quicker approvals and increased user satisfaction. Chatbots also help manage compliance with regard to loan regulation, and enable secure processing of sensitive loan application information.

In the ever evolving world, through the implementation of AI chatbots, these financial institutions can improve customer experiences, automate processes, and stay ahead in a fast-changing industry. In the future, these institutions will increasingly depend on advanced finance AI chatbot solutions.

Features to Look for in a Chatbot for Financial Services

Choosing the appropriate chatbot for financial services is essential to improve customer experience, maintain security, and optimize operations. Some of the most important features to look for are:

Advanced AI & NLP

A chatbot must utilize advanced AI and NLP features to interpret and answer customer questions correctly, allowing for human-like interactions. Improvements in AI, including generative AI consulting, are making conversations more natural and beneficial.

Security & Compliance

Since financial information is sensitive, you must use a secure AI chatbot for banking that complies with industry standards like KYC/AML and GDPR, and undertake effective security policies for safeguarding customer data. Privacy of the data is equally critical.

Omnichannel Capabilities

Having the potential to work proficiently across several channels—such as websites, mobile applications, and social networks—provides for a continuous and convenient consumer experience. And so, when looking for a chatbot for financial services, make sure to look for omnichannel capability.

Voice AI & Multilingual Support

The integration of voice recognition and multiple language support makes the chatbot accessible to customers of diverse languages, promoting greater inclusivity and ease of use.

Integration with Banking & FinTech APIs

To provide real-time services like balance checks and transaction handling, the chatbot must seamlessly integrate with existing banking and fintech APIs.

Live Chat Handoff

For intricate queries, the chatbot must create a seamless live chat handover to human support agents, thus ensuring that the customer is able to get due assistance when necessary.

Predictive Analytics

With the use of predictive analytics, the chatbot can provide customized financial guidance and predict customer needs, thus increasing engagement and satisfaction.

In the sophisticated financial environment at present and future, the inclusion of these features ensures that a financial services chatbot is capable of addressing the changing needs of customers while ensuring operational efficiency and security. In the future, these features will be even more important as AI technologies continue to evolve.

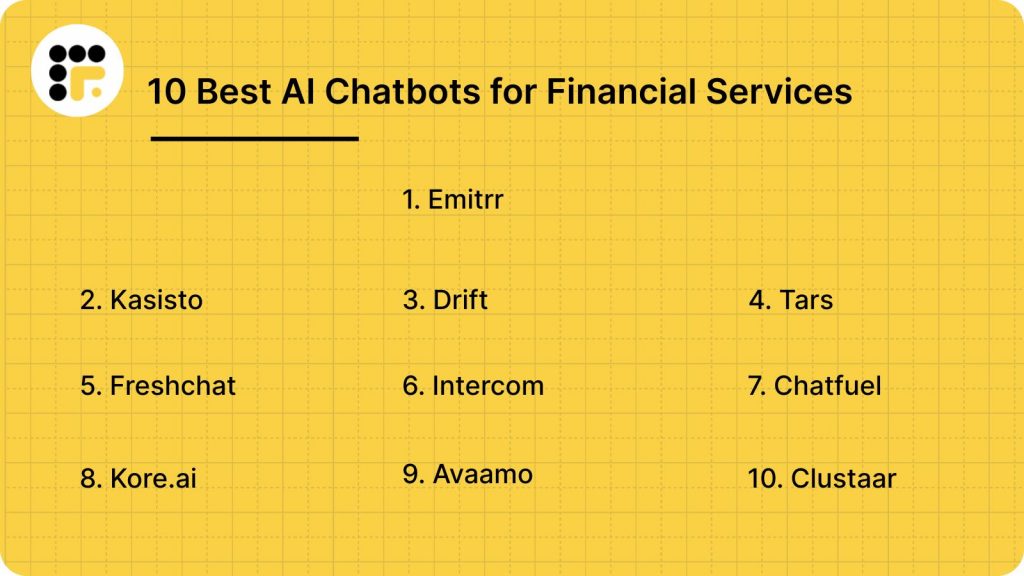

Top 10 AI Chatbots for Financial Services

1. Emitrr (Best AI Chatbot for Banking Overall)

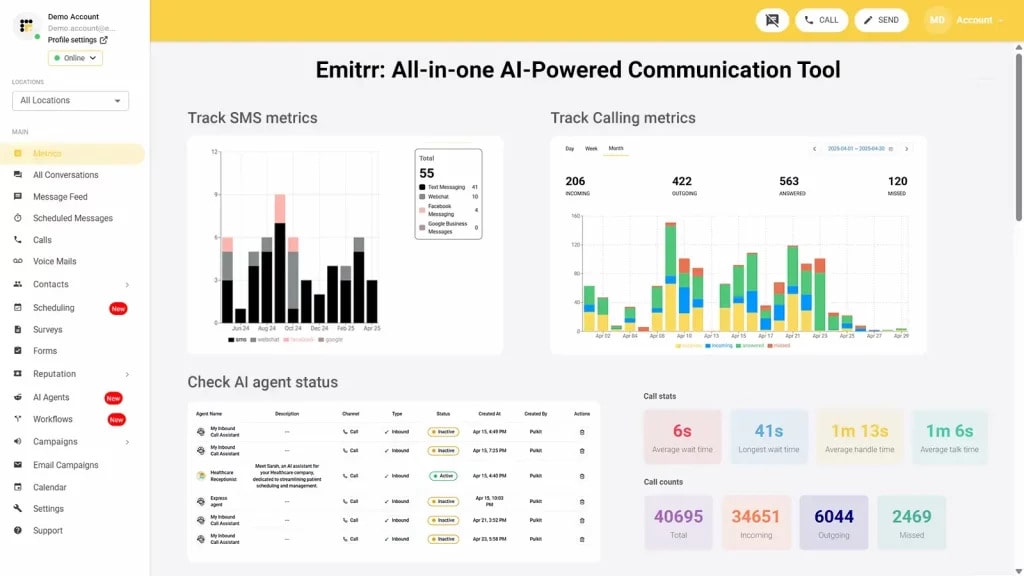

What is Emitrr?

Emitrr is an AI-powered chatbot designed to streamline customer interactions and automate key financial services processes. It caters to banks, insurance companies, wealth management firms, fintech startups, and lending platforms by offering intelligent conversational capabilities. With its advanced AI-driven automation, this secure AI chatbot for banking helps enhance customer experience, improve efficiency, and ensure AI and regulatory compliance in finance.

Emitrr Features

- AI-Powered Customer Support: Emitrr’s chatbot uses Natural Language Processing (NLP) and Machine Learning (ML) to understand and respond to customer inquiries in real-time, reducing the workload on human agents.

- Automated Transaction Assistance: It can assist customers with checking account balances, processing payments, scheduling loan payments, and setting up automated bill reminders.

- Fraud Detection & Security Alerts: Emitrr integrates with financial security systems to detect unusual transactions, alert customers in real-time, and provide fraud prevention guidance.

- KYC & Onboarding Automation: The chatbot streamlines Know Your Customer (KYC) processes by collecting necessary documents, verifying user identities, and assisting in account opening procedures.

- Loan & Mortgage Assistance: Emitrr automates loan eligibility checks, EMI calculations, document collection, and loan application status tracking.

- Claims & Policy Management for Insurance: For insurance providers, Emitrr helps customers file claims, check claim statuses, access policy details, and receive automated reminders for policy renewals.

- Personalized Financial Advice: Emitrr can provide tailored investment insights, budgeting tips, and savings recommendations based on user spending patterns and financial goals.

- Omnichannel Integration: Seamlessly connects with banking websites, mobile apps, WhatsApp, SMS, email, and voice assistants, ensuring consistent customer service across multiple touchpoints.

- Seamless CRM & API Integrations: Emitrr integrates with core banking systems, fintech APIs, and CRM platforms to synchronize customer data and provide real-time assistance.

- Live Agent Handoff: In complex cases, the chatbot smoothly transfers conversations to human representatives while preserving the context of the interaction.

- Chatbot integration with core banking systems: Emitrr’s AI chatbot for banking can be integrated with core banking systems, such as Finacle, Temenos, FIS, etc.

Watch how Emitrr AI agent Sarah can make texting effortless:

Emitrr Pros

- AI-Driven Efficiency: Automates repetitive tasks, reducing operational costs and improving response time for financial institutions.

- Bank-Grade Security: Implements encryption, multi-factor authentication (MFA), and compliance with GDPR, PCI-DSS, and other financial regulations.

- Multilingual Support & Voice AI: Provides services in multiple languages and supports voice-based interactions for a seamless customer experience.

- Scalability & Customization: Adaptable for small businesses, mid-sized firms, and enterprise-level financial institutions.

- Real-Time Insights & Analytics: Tracks customer interactions, fraud patterns, loan inquiries, and financial trends through interactive dashboards.

Emitrr Cons

Emitrr is constantly evolving and actively testing innovative features. As a result, no significant drawbacks have been reported by users at this time.

Emitrr Pricing

Emitrr offers flexible pricing tailored to financial institutions, with scalable plans based on chatbot features, integrations, and the volume of customer interactions. Pricing for AI starts at $99 per month and varies depending on enterprise needs.

Emitrr Integrations

- Core Banking Systems

- Loan Management Software

- Stripe

- Razorpay

- PayU

- HubSpot

Emitrr Reviews & Ratings

Emitrr has a customer rating of 4.8 on Capterra and 4.7 on G2.

“It’s very easy to use and the developers and team have an incredibly efficient and fast response time.”

“Emitrr has countless integrations and features that make it the best platform to text available.”

Source: Capterra

Emitrr Support Channels

- Live Chat: Connect instantly via the website’s live chat feature.

- Phone: Reach the team directly at +1 (210) 941-4696.

- Email: For assistance, contact support@emitrr.com.

- Knowledge Base: Access a comprehensive library of articles and guides for self-help.

- FAQs/Forum: Engage with the community and find answers to common questions.

- SMS: Get in touch directly by sending a message via SMS.

2. Kasisto

What is Kasisto?

Kasisto is a leading provider of conversational AI for finance, specializing in creating intelligent virtual assistants for the financial services industry. Their flagship product, KAI, enables banks and financial institutions to offer personalized, human-like interactions to their customers, enhancing digital engagement and streamlining operations.

Kasisto Features

- Conversational AI for finance: KAI leverages advanced natural language processing to understand and respond to customer inquiries, facilitating seamless interactions.

- Omni-Channel Support: The platform integrates across multiple channels, including mobile apps, websites, and messaging platforms, ensuring consistent user experiences.

- Personalized Banking Services: KAI provides tailored financial advice, transaction support, and account management, enhancing customer satisfaction.

- Analytics and Insights: The platform offers data analytics tools to monitor user interactions and optimize services.

- Secure AI chatbot for banking: With security and compliance being core features, Kasisto offers a secure AI chatbot for banking.

Kasisto Pros

- Financial Expertise: Specializes in the financial sector, offering industry-specific solutions.

- Scalability: Caters to institutions of various sizes, from small banks to global enterprises.

- Enhanced Customer Engagement: Improves customer interaction through personalized and efficient service.

Kasisto Cons

- Pricing Structure: This AI chatbot for finance may be cost-prohibitive for smaller institutions.

- Integration Complexity: Implementing this conversational AI in finance may require significant resources.

Kasisto Pricing

The software is priced based on the number of users, with costs varying accordingly. For small businesses with 1 to 10 users, pricing begins at $50 per user per month.

Kasisto Integrations

- Finastra

- AWS

- FIS

- Candescent

Kasisto Support Channels

- Customer Support: Offers dedicated support services to assist clients.

- Training & Certifications: Provides resources for effective platform utilization.

3. Drift

What is Drift?

Drift is an AI-powered buyer engagement platform designed to facilitate real-time, personalized interactions between businesses and their customers. By leveraging conversational marketing and sales tools, Drift aims to enhance customer experience, streamline communication, and accelerate the sales cycle

Drift Features

- Conversational Chatbots: Drift’s AI-driven chatbots engage website visitors in real-time, qualifying leads, answering queries, and routing prospects to the appropriate sales representatives.

- Live Chat: Allows sales and support teams to interact directly with website visitors, providing immediate assistance and fostering personalized customer experiences.

- Email Management: Drift consolidates email communications, enabling teams to manage conversations efficiently and maintain context across multiple channels.

- Meeting Scheduler: The platform offers a scheduling tool that syncs with calendars, allowing prospects to book meetings directly, reducing friction in the sales process.

- Analytics and Reporting: This AI chatbot for finance offer insights into user interactions, team performance, and campaign effectiveness, facilitating data-driven decision-making.

Drift Pros

- User-Friendly Interface: The platform is intuitive, making it accessible for teams without extensive technical expertise.

- Enhanced Lead Qualification: Drift’s chatbots effectively qualify leads in real-time, ensuring sales teams focus on high-potential prospects.

- Seamless Integration: This banking chatbot integrates smoothly with various CRM systems and marketing tools, enhancing workflow efficiency

Drift Cons

- Missing Features: Users may find the platform lacks certain features they consider essential for their specific use cases or industry. This can limit the platform’s overall effectiveness.

- Notification Issues: Problems with notifications, such as delays, unreliability, or difficulty customizing them, can hinder timely responses and efficient workflow management.

- Routing Issues: Problems with the routing of conversations to the correct agents or teams can lead to delays in response times and a negative impact on customer experience.

Drift Pricing

Specific pricing details for Drift are not publicly disclosed and may vary based on business size and requirements.

Drift Integrations

- Salesforce

- HubSpot

- Marketo

- Eloqua

Drift Reviews & Ratings

Drift has a customer rating of 4.5 on Capterra and 4.4 on G2.

“Very intuitive and easy to use, you don’t need to be an expert to implement your communication strategy with this tool.”

“The free version is rather limited in terms of features.”

Source: Capterra

Drift Support Channels

- Help Center: A comprehensive resource with articles and guides.

- Live Chat Support: For real-time assistance.

- Email Support: For detailed inquiries.

- Community Forums: To connect with other users and share best practices

- Calling Support: One can reach out on +1 (770) 756 -8022

4. Tars

What is Tars?

Tars is a no-code conversational AI for finance that enables businesses to create and deploy chatbots for automating customer interactions across various channels. By leveraging AI-powered conversations, Tars aims to enhance customer experience, reduce support costs, and streamline workflows without requiring programming expertise. Here is a deeper overview as to why Tars is considered the best AI chatbot for financial institutions:

Tars Features

- No-Code Chatbot Builder: Tars provides a drag-and-drop interface, allowing users to design and customize chatbots without any coding skills. This feature facilitates quick deployment and easy updates to chatbot workflows.

- AI-Powered Conversations: Integrating OpenAI’s GPT-3.5 Turbo, Tars chatbots can understand and respond to user inputs effectively, delivering more human-like interactions.

- Multi-Channel Deployment: Chatbots built with Tars can be deployed across various platforms, including websites and WhatsApp, ensuring consistent customer engagement.

- Analytics and Reporting: The platform offers analytics tools to monitor chatbot performance, user interactions, and conversion rates, enabling data-driven optimization.

- Integrations: This AI chatbot for finance integrates with popular tools such as Zendesk, Google Calendar, and HubSpot, allowing seamless workflow automation and data synchronization.

Tars Pros

- User-Friendly Interface: The intuitive design of the platform makes chatbot creation accessible to users without technical backgrounds.

- Customizable Templates: With access to a vast library of chatbot templates across various industries, users can quickly deploy bots tailored to specific business needs.

- Scalability: Tars caters to businesses of all sizes, offering features that support growth and increased customer interaction volumes

Tars Cons

- Feature Accessibility: Some advanced functionalities may be limited to higher-tier plans, which could be a consideration for smaller businesses with budget constraints.

- Only No Code: The platform’s exclusive focus on a no-code approach might limit users who require more advanced customization options.

- Learning Curve for Advanced Features: While basic features are straightforward, mastering more complex capabilities of this conversational AI in finance may require additional time and resources.

Tars Pricing

Tars offers a variety of pricing plans tailored to different business needs. Pricing can vary based on the features and scale of the solution you require.

Tars Integrations

- Zendesk

- Google Calendar

- HubSpot

Tars Reviews & Ratings

Tars has a customer rating of 4.6 on G2.

“I like how easy it is to use product. The design is simple and make things straightforward. It really helps us get things done more easily. Overall, the product is both reliable and easy to use, which makes it a great choice for us.”

“The only point is the analytics part because the reporting is not as per our process requirement which needs immediate attention and support. Also weekend support required to ensure any error is immediately taken care keeping customer satisfaction on priority.”

Source: G2

Tars Support Channels

- Help Center: A comprehensive resource with articles, guides, and tutorials on various aspects of the platform.

- Live Chat Support: Provides real-time assistance for immediate queries and technical support.

- Email Support: Users can reach out via email for detailed inquiries or support requests.

- Calling Support: One can reach out on +1 (408) 617-9159

5. Freshchat (Freshworks)

What is Freshchat?

Freshchat is a modern messaging platform developed by Freshworks, designed to facilitate seamless and personalized customer communication across various channels. It enables businesses to engage with their customers in real-time, offering tools for live chat, AI-driven bots, and integrations with multiple messaging services

Freshchat Features

- Omnichannel Messaging: Manage customer conversations from various platforms, including websites, mobile apps, WhatsApp, Facebook Messenger, and more, within a single unified inbox.

- AI-Powered Chatbots: Utilize AI-driven bots to handle common inquiries, provide instant responses, and assist in resolving customer issues efficiently.

- Live Chat Support: Offer real-time assistance to website visitors and app users, enhancing customer engagement and satisfaction.

- Intelligent Routing: Automatically direct conversations to the most appropriate team members based on predefined rules, ensuring efficient query resolution.

- In-App Messaging: Engage users directly within your mobile application, providing contextual support and updates.

- Analytics and Reporting: Access detailed insights into team performance, customer satisfaction, and chat metrics to make data-driven decisions.

Freshchat Pros

- User-Friendly Interface: The platform is intuitive and easy to navigate, reducing the learning curve for new users.

- Comprehensive Integrations: Seamlessly integrates with various platforms and tools, including CRM systems and e-commerce platforms, enhancing its versatility.

- Scalability: Suitable for businesses of all sizes, from startups to large enterprises, due to its flexible features and pricing plans.

- AI and Automation: The inclusion of AI-powered chatbots and automation features helps in reducing response times and operational costs.

Freshchat Cons

- Feature Accessibility: Some advanced features may be limited to higher-tier plans, potentially increasing costs for small businesses.

- Customization Limitations: Certain customization options may be restricted, limiting the ability to tailor the platform to specific business needs.

Freshchat Pricing

Freshdesk pricing starts from $19, offering additional features like advanced integrations and automation. It also has a free plan $0 for up to 10 agents, including basic features suitable for small teams.

Freshchat Integrations

- Salesforce

- HubSpot

- Microsoft Teams

- Slack

Freshchat Reviews & Ratings

Freshchat has a customer rating of 4.1 on Capterra and 4.4 on G2.

“I love how easy the dashboard was and how easy it was to set up on my wordpress website. The chat was also very clean, very easy to use multiple members of my team. The app on my phone made it simple to chat with visitors on my website from my phone.”

“While I started off with a free version, the paid version was a little too expensive for what I wished to use. I found a cheaper alternative.”

Source: Capterra

Freshchat Support Channels

- Live Chat: Access real-time support through the integrated live chat feature.

- Email Support: Get detailed assistance for technical or account-related queries.

- Phone Support: Available on select plans for immediate, personalized help.

- Knowledge Base: Utilize a comprehensive collection of guides, tutorials, and FAQs for self-service support.

6. Intercom

What is Intercom?

Intercom is an AI-first customer service platform designed to enhance customer experiences, improve operational efficiency, and scale with businesses as they grow. Trusted by global organizations. Intercom offers a suite of tools that facilitate personalized and efficient customer interactions.

Intercom Features

- AI Agent (Fin): Fin is an AI-powered agent capable of resolving a significant portion of support volume instantly, providing human-quality service around the clock. It’s recommended to verify the most up-to-date resolution rate with Intercom.

- Omnichannel Support: Intercom consolidates conversations from various channels—including email, phone, messenger, WhatsApp, SMS, and social media—into a single inbox, allowing support teams to manage all interactions seamlessly.

- Help Center: Businesses can create an integrated, on-brand help center accessible through any channel, enabling customers to find accurate answers themselves.

- Copilot: An AI assistant designed to work alongside support agents, Copilot provides instant, expert answers by accessing a wide range of sources, enhancing agent productivity.

- AI Insights & Reporting: Intercom offers robust reporting tools that provide performance-boosting AI optimization insights, helping support leaders make data-driven decisions.

Intercom Pros

- AI-Driven Efficiency: Integrating AI tools like Fin and Copilot enhances customer and agent experiences by providing instant, accurate responses and support.

- Unified Communication: The omnichannel approach ensures all customer interactions are managed within a single platform, streamlining support processes.

- Scalability: Intercom’s platform is designed to grow with businesses, accommodating increasing support demands without compromising service quality.

Intercom Cons

- Cost Considerations: While Intercom offers a range of features, the pricing may be a consideration for smaller businesses or startups with limited budgets.

- Complexity for New Users: The breadth of features available can present a learning curve for new users, potentially requiring time to fully leverage the platform’s capabilities.

Intercom Pricing

Intercom offers various pricing plans tailored to different business needs. The starter pack starts at $29 per month.

Intercom Integrations

- Stripe

- Jira

- Zoho

- Shopify

- Salesforce

- Hubspot

Intercom Reviews & Ratings

Intercom has a customer rating of 4.5 on Capterra and 4.5 on G2.

“Relatively simple interfaces and api endpoints. Interesting AI integrations/product features.”

“Issues with basic customer management concepts such as merges. Development team seemed unresponsive to potential product issues, yet aware they existed.”

Source: Capterra

Intercom Support Channels

- Help Center: A comprehensive resource with articles and guides to assist users in navigating and utilizing Intercom’s features.

- Community Forum: A platform where users can engage with Intercom Support and Community Experts to find answers and share insights.

- Live Chat Support: Available for real-time assistance, allowing users to connect directly with support agents for immediate help.

- Online Courses and Webinars: Intercom provides educational resources to help users maximize the platform’s potential, including courses and webinars on various topics.

7. Chatfuel

What is Chatfuel?

Chatfuel is a top no-code platform for developing chatbots that allows businesses to create AI-powered chatbots for platforms including Facebook Messenger, Instagram, WhatsApp, and websites. Designed to automate customer interactions, Chatfuel helps businesses enhance engagement, generate leads, and boost sales without requiring extensive programming knowledge

Chatfuel Features

- No-Code Chatbot Builder: Enables users to create and launch chatbots without coding, using a user-friendly drag-and-drop interface.

- Omnichannel Support: Enables integration across multiple platforms, including Facebook Messenger, Instagram, WhatsApp, and websites, ensuring consistent customer engagement.

- AI-Powered Automation: Utilizes artificial intelligence to handle customer inquiries, provide prod

- uct recommendations, and manage bookings, enhancing user experience.

- Audience Segmentation: Segments users based on behavior and preferences, allowing for targeted and personalized messaging.

Analytics and A/B Testing: Provides real-time analytics and A/B testing features to enhance chatbot performance and user engagement.

Chatfuel Pros

- User-Friendly Interface: The platform’s no-code builder makes it accessible for users without technical expertise to create and manage chatbots.

- Comprehensive Integration Options: Supports chatbot integration with core banking systems, including CRMs, and e-commerce platforms, to streamline business processes.

- Scalability: Suitable for businesses of all sizes, from small enterprises to large corporations, due to its flexible features and pricing plans.

Chatfuel Cons

- Platform Focus: Primarily designed for social media platforms, which may limit functionality for businesses seeking chatbot solutions beyond these channels.

- Feature Limitations in Free Plan: The free version offers limited features, necessitating a subscription to access advanced functionalities.

- Learning Curve for Advanced Features: While basic setup is straightforward, mastering advanced features may require additional time and learning.

Chatfuel Pricing

Chatfuel offers a free plan with basic features and paid plans starting at $15 per month, making it one of the most affordable chatbots in finance.

Chatfuel Integrations

- Zapier

- Shopify

- Kommo CRM

- Stripe

- API

Chatfuel Reviews & Ratings

Chatfuel has a customer rating of 4.3 on Capterra and 4.4 on G2.

“I run a very small business that sells used baby strollers and relies on customers placing orders via Facebook Messenger. We set up Chatfuel to automate the initial part of the conversation and it has worked well.”

“NLP is not good enough as it should be. Sometimes my bot failed to recognize the user’s inputs and does not respond.”

Source: Capterra

Chatfuel Support Channels

- Help Center: Access to comprehensive documentation and guides for troubleshooting and learning.

- Community Forum: A platform for users to share experiences, ask questions, and receive peer support.

- Live Chat Support: Real-time assistance for immediate concerns and inquiries.

- Udemy Course: Offers a free course on mastering WhatsApp ChatGPT AI bots with Chatfuel.

8. Kore.ai

What is Kore.ai?

Kore.ai is a leading enterprise conversational AI platform that enables organizations to design, build, and manage intelligent virtual assistants and chatbots across various channels. Kore.ai focuses on enhancing customer and employee experiences through advanced AI technologies.

Kore.ai Features

- No-Code Development Platform: Allows users to create and deploy virtual assistants without extensive coding knowledge, streamlining the development process.

- Omnichannel Support: Enables seamless integration across multiple communication channels, including web, mobile apps, messaging platforms, and voice assistants, ensuring consistent user experiences.

- Advanced Natural Language Processing (NLP): Utilizes sophisticated NLP capabilities to understand and process user intents, facilitating more accurate and human-like interactions.

- Pre-Built Industry Solutions: Offers tailored virtual assistant templates for specific industries such as banking, healthcare, and retail, accelerating deployment times and ensuring relevance. It’s recommended to verify the specific industries covered directly with Kore.ai.

- Analytics and Reporting: Provides comprehensive analytics to monitor virtual assistant performance, user engagement, and interaction effectiveness, aiding in continuous improvement.

Kore.ai Pros

- User-Friendly Interface: The platform’s intuitive design simplifies the creation and management of virtual assistants, making it accessible to users with varying technical expertise.

- Comprehensive Integration Capabilities: Kore.ai supports chatbot integration with core banking systems, enhancing the functionality and reach of virtual assistants.

- Scalability: Designed to accommodate the needs of large enterprises, the platform efficiently handles high volumes of interactions without compromising performance.

Kore.ai Cons

- Usage Limitations: Some advanced features, such as deep AI customization and extensive API integrations, may have restrictions depending on the pricing tier.

- Learning Curve: While the platform offers a no-code interface, users unfamiliar with AI and NLP concepts may require time to fully utilize its capabilities.

- Slow Performance: Some users have reported occasional lags when processing complex queries or handling high volumes of interactions, affecting response time.

- Poor Documentation: While Kore.ai provides support resources, some users have found the documentation insufficiently detailed, making troubleshooting and implementation more challenging.

Kore.ai Pricing

Prospective clients are encouraged to contact Kore.ai directly to obtain detailed pricing information.

Kore.ai Integrations

- Zoho

- Salesforce

- Microsoft

- HubSpot

Kore.ai Reviews & Ratings

Kore.ai has a customer rating of 4.5 on Capterra and 4.7 on G2.

“The dialog tasks are very easy to implement, the types of input which are needed are very neatly documented and implemented, all of the options are very to navigate, some of the features like masking, small talk, and basic training is done by the builder itself. It’s easy to add channels, use the agent transfer and expose the APIs.”

“The integration configurations can be very messy and impactful on CX e.g. disconnection of chats between Kore and Zendesk – Kore Team can improve further on their familiarization with integration to ticketing platforms.”

Source: Capterra

Kore.ai Support Channels

- Documentation: Access detailed guides and resources to assist with platform utilization and virtual assistant development.

- Community Forum: Engage with other users and experts to share knowledge, seek advice, and discuss best practices.

- Kore.ai Academy: Participate in training programs and courses designed to enhance your proficiency with the platform.

9. Avaamo

What is Avaamo?

Avaamo is a venture-funded conversational AI enterprise software company that specializes in deep-learning technologies to create conversational interfaces for banking enterprises. Their platform leverages neural networks, speech synthesis, and advanced AI to automate various aspects of business communication.

Avaamo Features

- Advanced Natural Language Processing (NLP): Understands and responds to complex financial queries with contextual awareness.

- Omnichannel Deployment: Supports integration across web, mobile apps, WhatsApp, Facebook Messenger, and voice assistants like Alexa and Google Assistant.

- Secure AI chatbot for banking: Ensures secure handling of sensitive data, adhering to industry regulations such as GDPR, HIPAA, and PCI DS

- Seamless API Integrations: Connects with enterprise systems, CRMs, banking applications, and payment gateways for smooth workflow automation.

- Multilingual & Voice AI Support: Communicates in multiple languages and supports voice interactions for enhanced accessibility.

- Live Agent Handoff: Transfers complex queries to human agents while maintaining conversation history for a seamless experience.

- AI-Powered Personalization: Customizes responses based on user behavior, transaction history, and preferences.

Avaamo Pros

- Enterprise-Ready: Designed for large-scale businesses with complex customer service needs.

- Highly Secure: Complies with global financial and healthcare security regulations.

- Scalable AI Models: Handles high volumes of customer interactions efficiently

Avaamo Cons

- Pricing Transparency: Custom pricing plans can make cost estimation difficult.

- Limited Small Business Focus: Primarily tailored for enterprise clients, making it less ideal for small businesses

Avaamo Pricing

Try the Avaamo platform with a free trial—no credit card, subscription, or hidden fees required. For tailored pricing that fits your business needs, contact Avaamo directly for a personalized quote.

Avaamo Integrations

- Zendesk

- Zoho

- SAP

- Salesforce

- Slack

- Cherwell

Avaamo Reviews & Ratings

Avaamo has a customer rating of 4.0 on Capterra.

“Multiple integrations with different channels Ease of creating conversation flows New platform features are developed and delivered constantly Ability to include JS with Node is very helpful User Authentication to the bot is rather easy to implement.”

“There is no way to keep session between channels Platform has too many problems with languages like Portuguese and Spanish, giving errors that can only be corrected by the platform’s team. No version control. Very expensive.”

Source: Capterra

Avaamo Support Channels

- Live Chat: Available through Avaamo’s official website for real-time assistance.

- Email Support: Contact support via email for technical inquiries and troubleshooting.

- Knowledge Base: Access documentation, FAQs, and user guides.

- Dedicated Account Managers: Offered for enterprise clients with premium support plans.

10. Clustaar

What is Clustaar?

Clustaar is an AI-driven chatbot platform designed for customer support automation in banking, particularly for SaaS companies. It enables businesses to create intelligent chatbots that can handle recurring questions, create support tickets automatically, and assist users in navigating product features

Clustaar Features

- Natural Language Processing (NLP): Utilizes advanced NLP capabilities to understand and respond to user inquiries effectively, enhancing the quality of interactions.

- Plug & Play Scenarios: Offers pre-built scenarios that allow for quick deployment of chatbots without extensive customization, facilitating rapid implementation.

- Integration Capabilities: Seamlessly integrates with platforms like Intercom and Zendesk, enabling unified customer support automation in banking experiences across different channels.

- Open APIs: Provides open APIs for developers, allowing for extensive customization and integration with existing systems to tailor the chatbot’s functionality to specific business needs.

- Multichannel Deployment: Supports deployment across various messaging services, ensuring consistent customer engagement regardless of the platform.

Clustaar Pros

- Enhanced Customer Support: Automates responses to common inquiries, reducing response times and allowing support teams to focus on more complex issues.

- Scalability: Capable of handling a large volume of interactions simultaneously, making it suitable for businesses experiencing rapid growth or high customer engagement.

- User-Friendly Interface: Designed with an intuitive interface that allows users with minimal technical expertise to create and manage chatbots effectively.

Clustaar Cons

- Pricing Transparency: Specific pricing details are not publicly disclosed, requiring potential users to contact the provider for customized quotes, which may be less convenient for budgeting purposes.

- Learning Curve: While user-friendly, some advanced features may require a learning period for users to fully leverage the platform’s capabilities.

Clustaar Pricing

Clustaar does not publicly disclose its pricing structure. Interested businesses are encouraged to contact Clustaar directly to obtain detailed pricing information tailored to their specific needs.

Clustaar Integrations

- Intercom

- Zendesk

Clustaar Reviews & Ratings

Clustaar has a customer rating of 4.5 G2.

“It helps us check all our URls for optimization,and especially for Beginners who are looking to learn a lot about SEO.”

“The integration process is slightly complicated.”

Source: G2

Clustaar Support Channels

- Community Forums: Enables users to engage with other Clustaar users to share experiences, solutions, and best practices

- Phone: Reach the team directly at +1 (210) 941-4696.

- Email & Ticket Support: Available through their official website.

Why is Emitrr the Best Chatbot for Financial Services?

In the fast-evolving financial sector, businesses need AI-driven banking solutions that not only automate customer interactions but also ensure security, compliance, and seamless user experiences. Emitrr stands out as one of the best chatbots for banks and financial services. Here’s why Emitrr is a preferred choice:

AI-driven efficiency

Emitrr harnesses advanced Finance AI automation chatbot and Natural Language Processing (NLP) to streamline customer interactions. It efficiently handles tasks like:

- Answering queries related to account balances, transactions, and loan applications.

- Automating appointment scheduling for financial consultations.

- Sending proactive notifications for payments, policy renewals, and investment updates.

- Reducing response times, improving customer satisfaction, and minimizing operational costs.

By automating repetitive tasks, financial institutions can free up human agents for more complex and high-value client interactions

Superior security

Security is a top priority in financial services, where data breaches can have devastating consequences. Emitrr ensures security measures, including:

- End-to-end encryption to protect sensitive financial data.

- Multi-factor authentication (MFA) for secure customer verification.

These security features make Emitrr one of the most reliable chatbots for banks and financial services.

Seamless customer engagement

Emitrr delivers a human-like conversational experience by understanding context and intent, thanks to its AI-driven chatbot framework.

- Multichannel support (SMS, WhatsApp, email, and voice AI) to meet customers on their preferred platforms.

- Instant response times, eliminating long wait periods and improving customer retention.

By providing a conversational banking experience, Emitrr helps financial institutions improve client satisfaction and loyalty.

Customization & Scalability

Emitrr is designed to grow with your business, offering:

- Seamless banking AI APIs integrations with core banking systems, CRM chatbot integration for finance, payment gateways, and fintech applications.

- AI-driven analytics & insights to track customer behavior and optimize chatbot performance.

- Scalability from small fintech startups to large financial enterprises, with flexible, volume-based pricing models.

Whether you’re a small lending platform or a multinational bank, Emitrr can adapt to your needs, ensuring high efficiency at scale.

Emitrr is a robust, secure, and scalable finance AI chatbot solution that is built to address the changing requirements of financial businesses. With its AI-powered customer support, strong security, and smooth integrations, it provides an enhanced customer experience while streamlining operations.

FAQs

Financial chatbots are designed with robust security measures to protect sensitive user data. They often employ encryption, secure authentication protocols, and compliance with financial regulations to prevent unauthorized access and data breaches.

Yes, modern financial chatbots are capable of managing complex transactions, including loan applications, investment management, and fraud detection. They utilize advanced AI automation and natural language processing to understand and process intricate financial tasks, providing users with efficient and accurate services.

To function effectively, a financial chatbot should integrate with:

Core Banking Systems: For real-time access to account information and transaction processing.

Customer Relationship Management (CRM) Platforms: To manage customer interactions and personalize services.

Fraud Detection Systems: To monitor and flag suspicious activities promptly.These integrations ensure the chatbot can provide comprehensive and secure financial services.

The cost of implementing a financial chatbot varies based on factors such as complexity, features, and deployment scale required by each company.

While chatbots can handle routine inquiries and transactions, they are not expected to replace human financial advisors entirely. The intricacies of financial planning often require nuanced expertise and a human touch, which chatbots currently lack. The future likely lies in a collaboration between AI-driven technology and human advisors, where chatbots handle routine tasks and provide initial guidance, freeing up advisors to focus on personalized strategic planning and complex financial situations.

AI chatbots improve financial customer service by ensuring personalized 24/7 support, instant resolutions, and enhanced security while also reducing cost for banks and financial institutions.

Chatbots reduce costs in financial services by 30-50% by being available 24/7 without needing to hire extra staff, and by saving time and cost that goes into handling routine queries.

Conclusion

Chatbots, powered by artificial intelligence, are now an essential tool in the financial services sector, providing automation, increased security, and intuitive customer interaction. Banks automating transactions, insurance firms processing claims, or fintech companies enhancing customer experience – chatbots are transforming the business of financial institutions.

After comparing the 10 best AI chatbots for financial institutions, it is clear that Emitrr is a great option to go for. So if you are ready to revolutionize your financial services with AI, then book your demo today and see the future of customer engagement.

4.9 (400+

reviews)

4.9 (400+

reviews)