Introduction

Let’s face it: Revenue cycle management is where profits go to die. Manual errors. Endless follow-ups. Missed payments. These aren’t just headaches—they’re silent profit killers hiding in your workflows.

But what if you could flip the script?

AI isn’t just another tech buzzword here—it’s your team’s new MVP. Imagine slashing claim denials by spotting errors before they happen. Or turning payment delays into instant reminders that customers actually respond to.

This is where AI steps in, transforming revenue cycle management from a back-office chore into a growth engine. From automating billing hiccups to predicting cash flow snags, AI doesn’t just fix problems—it stops them cold.

Ready to see how AI can turn your revenue cycle into a well-oiled, profit-boosting machine? Let’s break down the game-changing solutions—and how tools like Emitrr AI make it as simple as flipping a switch.

What is AI in Revenue Cycle Management?

Revenue Cycle Management (RCM) is a complex, multi-step process that involves managing the financial transactions related to services provided by businesses, especially in industries like healthcare. Traditionally, revenue cycle management processes have been labor-intensive, highly dependent on manual data entry, and susceptible to errors and inefficiencies. These challenges are compounded by evolving regulations, high rates of claim denials, and increasing pressure to improve cash flow and reduce operational costs.

Businesses across industries often face critical issues such as:

- Complex and ever-changing billing regulations

- High rates of claim denials due to coding errors or incomplete documentation

- Inefficient payment collections and delayed cash flow

- Resource-intensive administrative workflows

These obstacles not only slow down revenue capture but also increase operational costs and expose organizations to financial risks. The complexity of managing claims, ensuring compliance, and engaging patients or clients financially demands more than just traditional automation.

Artificial Intelligence (AI) in Revenue Cycle Management addresses these challenges by leveraging advanced technologies like machine learning, natural language processing, and predictive analytics to create a smarter, more adaptive revenue process. AI goes beyond automating routine tasks by:

- Enhancing regulatory compliance and adaptability: AI continuously monitors regulatory changes and payer policies, helping businesses maintain compliance and reduce costly claim denials caused by outdated or incorrect coding and documentation.

- Reducing claim denials through intelligent validation: By analyzing clinical and billing data in real-time, AI identifies inconsistencies and missing information before claims submission, significantly improving accuracy and speeding up reimbursement cycles.

- Mitigating workforce challenges: With increasing workloads and staffing shortages, AI supports teams by handling complex data analysis and exception management, reducing human error, and freeing staff to focus on higher-value activities.

- Improving patient communication and client financial engagement: AI-driven communication tools personalize billing interactions, offer flexible payment plans, and proactively manage collections, addressing the growing challenge of patient financial responsibility and improving overall cash flow.

- Predicting revenue risks and preventing leakage: AI models analyze historical and current data to forecast payment delays, denials, or underpayments, enabling proactive interventions that safeguard revenue.

- Providing actionable insights for strategic decisions: By synthesizing vast amounts of structured and unstructured data, AI delivers real-time analytics and performance metrics, empowering leadership to identify bottlenecks, optimize processes, and enhance financial outcomes.

- Seamlessly integrating with existing systems: AI solutions are designed to work alongside legacy platforms, electronic health records, and billing systems, ensuring scalable improvements without disrupting current operations.

This way, it transforms into an intelligent, proactive system enabling businesses to not only automate but also optimize and future-proof their revenue operations—maximizing financial performance in an increasingly complex and competitive environment.

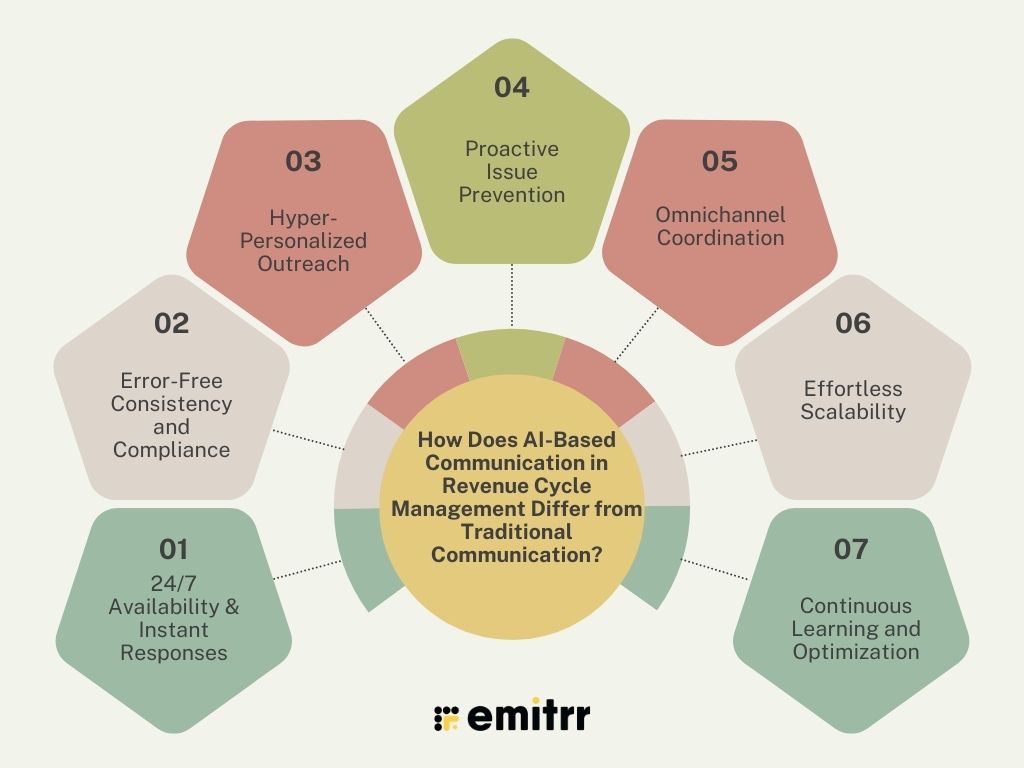

How Does AI-Based Communication in Revenue Cycle Management Differ from Traditional Communication?

AI-based communication is fundamentally changing revenue cycle management (Revenue Cycle Management) across industries such as healthcare, insurance, utilities, and telecommunications. Unlike traditional methods—manual calls, emails, and letters that often result in delays, errors, and inconsistent follow-up—AI-powered solutions introduce intelligence, personalization, and efficiency at every touchpoint.

24/7 Availability & Instant Responses

AI agents, both voice and text, operate around the clock. This means customers, patients, or clients can get immediate answers to billing inquiries, payment reminders, or account questions at any time, eliminating the wait times and limited hours of human agents. This is especially valuable in industries with high transaction volumes and customers in different time zones.

Error-Free Consistency and Compliance

AI agents follow data-driven protocols and adapt messaging based on real-time information, ensuring every communication is accurate and compliant with the latest regulations. This reduces human error, which is a common cause of claim denials and compliance issues in Revenue Cycle Management.

Hyper-Personalized Outreach

AI analyzes payment history, preferences, and risk profiles to tailor reminders, payment plans, or follow-ups via the customer’s preferred channel—whether that’s a call, SMS, chat, or email. This level of personalization increases engagement rates and improves the likelihood of timely payments.

Proactive Issue Prevention

AI doesn’t just react—it predicts. By analyzing historical data, AI agents can identify accounts at risk of delayed payments or disputes and reach out proactively with solutions, such as flexible payment plans or clarifications. This helps prevent revenue leakage and reduces the need for costly escalations.

Omnichannel Coordination

AI agents seamlessly manage interactions across multiple channels—phone, SMS, chat, and email—ensuring customers receive consistent and timely information through their preferred methods. This omnichannel approach reduces customer frustration and streamlines the payment process.

Effortless Scalability

AI agents can handle thousands of simultaneous interactions, making them ideal for industries like utilities and telecom, which serve large customer bases. This scalability is not possible with traditional staff-based methods and is crucial for organizations aiming to grow without proportionally increasing costs.

Continuous Learning and Optimization

AI systems learn from every interaction, using feedback and analytics to continuously refine scripts, timing, and outreach strategies. This leads to ongoing improvements in collection rates, customer experience, and operational efficiency.

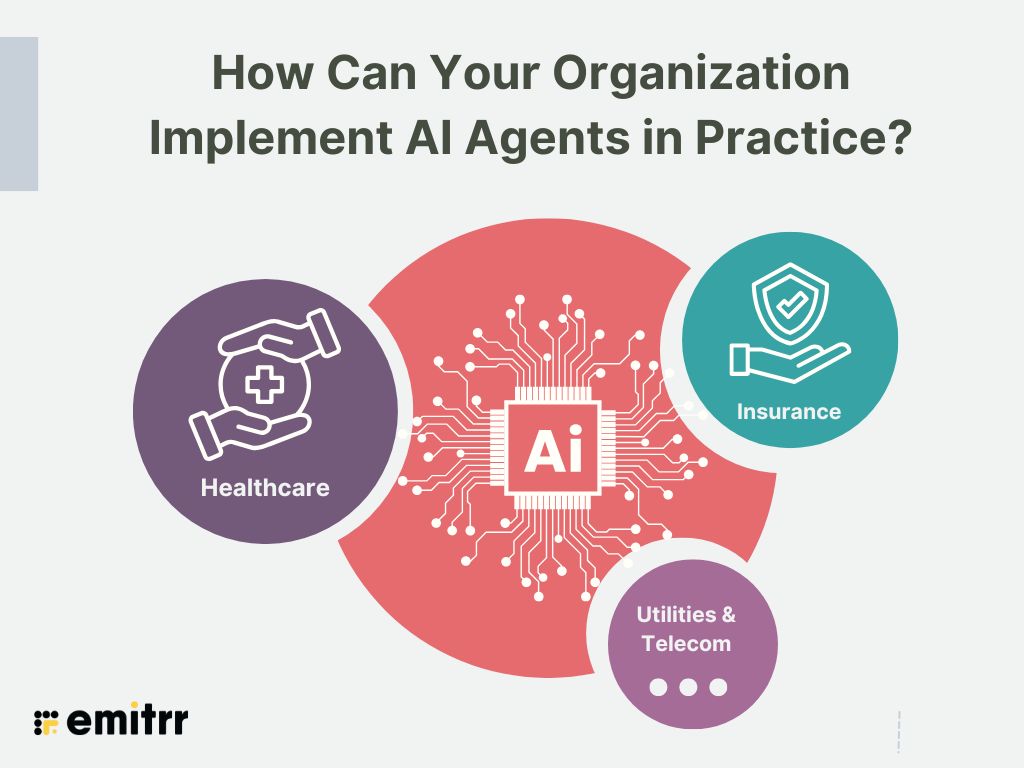

How Can Your Organization Implement AI Agents in Practice?

Healthcare:

AI agents answer patient billing questions, send personalized payment reminders, clarify insurance coverage, and even assist with appeals for denied claims. Hospitals using AI have reported reduced claim denials, faster payment cycles, and improved patient satisfaction.

Insurance:

AI manages premium reminders, claims follow-ups, and policy updates via SMS or call, reducing manual workload and improving response accuracy. AI can also analyze unstructured notes to recommend the most effective actions for accounts receivable recovery.

Utilities & Telecom:

AI agents handle billing notifications, negotiate payment plans via text, and alert customers about overdue accounts. This ensures timely collections, reduces service disruptions, and enhances customer satisfaction—especially in sectors with high transaction frequency and diverse customer bases.

AI agents don’t just automate tasks—they transform how businesses connect with customers, clients, and patients. By combining speed, personalization, proactive problem-solving, and data-driven insights, AI reduces costs, accelerates cash flow, and builds stronger relationships. This is increasingly vital as organizations face rising costs, regulatory complexity, and growing expectations for seamless digital experiences

AI Agent vs. Traditional Automation: Key Differences

| Aspect | Traditional Automation | AI Agent-Powered Communication |

| Availability | Limited to preset schedules | 24/7, instant responses |

| Data Handling | Basic CRM updates | Contextual, error-free sync with insights |

| Personalization | Template-based messages | Dynamic, sentiment-aware customization |

| Learning | Static workflows | Continuously improves from interactions |

| Proactivity | Reactive reminders | Predicts issues and acts preemptively |

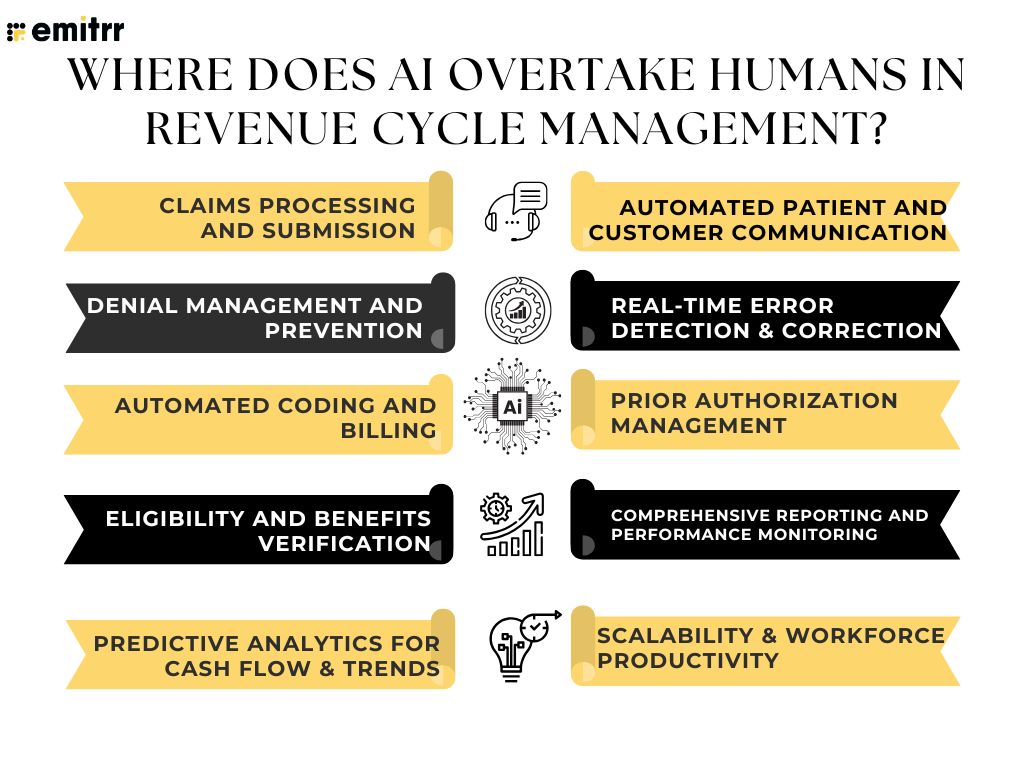

Where Does AI Overtake Humans in Revenue Cycle Management?

For businesses operating in revenue cycle management (Revenue Cycle Management)—whether in healthcare, insurance, utilities, or telecommunications—AI is no longer just a tool for automation; it’s a strategic asset that delivers measurable improvements in speed, accuracy, and profitability. As Revenue Cycle Management processes become increasingly data-intensive and complex, AI consistently outperforms human-driven approaches in several mission-critical areas:

1. Claims Processing and Submission

AI can process and submit claims at a speed and scale unattainable by manual teams. By automatically validating data and flagging errors before submission, AI reduces costly mistakes and accelerates the time to payment, directly boosting cash flow.

2. Denial Management and Prevention

AI systems analyze historical data to predict which claims are likely to be denied and proactively resolve issues before submission. Automated resubmission workflows increase the rate of successful reimbursements and allow staff to focus on higher-value tasks.

3. Automated Coding and Billing

AI-powered coding tools extract and assign the most accurate codes from documentation, reducing human error and ensuring compliance with regulatory standards. This leads to fewer rejected claims and faster revenue capture, directly impacting the bottom line.

4. Eligibility and Benefits Verification

AI instantly verifies insurance eligibility and benefits by cross-referencing multiple data sources in real time. This eliminates manual bottlenecks and ensures that only eligible claims are submitted, reducing rework and administrative delays.

5. Predictive Analytics for Cash Flow and Trends

AI analyzes vast datasets to forecast payment trends, customer behavior, and cash flow. These actionable insights enable better financial planning, resource allocation, and risk mitigation—capabilities that are essential for scaling operations and staying competitive.

6. Automated Patient and Customer Communication

AI-driven chatbots and virtual assistants manage routine billing inquiries, payment reminders, and appointment scheduling across multiple channels. This ensures 24/7 support, consistent messaging, and higher engagement rates, all while reducing operational costs.

7. Real-Time Error Detection and Correction

AI continuously scans for inconsistencies, missing information, and potential fraud, correcting errors before they escalate. This level of vigilance and speed is impossible for human teams, especially as transaction volumes grow.

8. Prior Authorization Management

AI rapidly identifies cases needing prior authorization, gathers the necessary documentation, and initiates approvals. This dramatically reduces turnaround times and administrative burdens, improving both efficiency and customer satisfaction.

9. Comprehensive Reporting and Performance Monitoring

AI generates detailed, real-time reports and dashboards on Revenue Cycle Management performance, highlighting bottlenecks and areas for improvement. These analytics empower leadership to make data-driven decisions and continuously optimize processes.

10. Scalability and Workforce Productivity

AI can handle thousands of transactions and interactions simultaneously, scaling seamlessly with business growth. This is especially valuable during peak periods or expansion phases, where human teams would struggle to keep pace without significant cost increases.

For businesses in Revenue Cycle Management, the adoption of AI isn’t just about keeping up with technology—it’s about gaining a competitive edge. By automating high-volume, repetitive, and data-driven tasks, AI enables your teams to focus on strategic initiatives, customer relationships, and innovation, ultimately driving higher profitability and operational resilience.

Where Do Humans Still Overtake AI in Revenue Cycle Management?

For business leaders optimizing Revenue Cycle Management, AI is a powerful tool for automation and analytics—but human expertise remains critical in areas that directly impact customer retention, compliance, and long-term revenue growth. Here’s how your team’s human strengths deliver unique value in an AI-driven Revenue Cycle Management ecosystem:

1. High-Stakes Customer Retention Conversations

When clients (e.g., patients, corporate accounts) dispute bills or face financial strain, empathetic human interaction preserves relationships. AI lacks the emotional intelligence to negotiate payment plans or de-escalate conflicts without risking churn.

The impact:

- Reduces customer attrition in competitive industries like telecom or SaaS.

- Builds loyalty through personalized financial accommodations.

2. Strategic Denial and Appeal Management

AI identifies denied claims, but humans craft appeals by interpreting payer contracts, clinical notes (in healthcare), or service-level agreements (in utilities/telecom) to maximize recovery.

The impact:

- Recovers 15-30% of revenue lost to denials through tailored appeals (industry-dependent).

- Mitigates risks in payer contract renegotiations.

3. Ethical Decision-Making in Revenue Recovery

Humans balance aggressive collections with brand reputation—e.g., waiving fees for long-term clients during crises or avoiding overly rigid AI-driven dunning campaigns.

The impact:

- Protects brand equity in reputation-sensitive sectors like healthcare or B2B services.

- Reduces regulatory penalties by ensuring ethical compliance.

4. Edge Case Resolution in Billing Disputes

AI struggles with non-standard billing scenarios (e.g., custom enterprise contracts or bundled services). Humans interpret ambiguous terms and resolve disputes without rigid rules.

The impact:

- Prevents revenue leakage from unprocessed or incorrectly flagged transactions.

- Maintains client trust during complex billing reconciliations.

5. Leadership in Revenue Cycle Management Process Design

Humans design workflows that integrate AI tools with existing ERP/CRM systems, ensuring scalability and alignment with business goals.

The impact:

- Accelerates ROI on AI investments through seamless implementation.

- Future-proof Revenue Cycle Management processes against regulatory or market shifts.

6. Staff Training and Change Management

Humans train teams to use AI tools effectively, interpret AI-generated insights, and foster a culture of continuous improvement.

The impact:

- Reduces resistance to AI adoption, ensuring smoother transitions.

- Empowers staff to focus on high-value tasks, boosting productivity.

7. Innovating Client Financial Experiences

Humans design client-centric billing models (e.g., usage-based pricing in SaaS or hardship programs in utilities) by analyzing feedback and market trends.

The impact:

- Differentiates your business in crowded markets through superior CX.

- Unlocks new revenue streams via flexible payment structures.

8. Negotiating Payer/Client Contracts

Humans leverage industry relationships and historical data to secure favorable payment terms, discounts, or SLAs—AI cannot replicate this strategic negotiation.

The impact:

- Improves cash flow predictability and reduces DSO (Days Sales Outstanding).

- Strengthens partnerships with high-value clients or payers.

9. Auditing AI Outputs for Compliance

Humans validate AI’s coding accuracy, fraud detection, and denial predictions to prevent systemic errors or regulatory violations.

The impact:

- Avoids costly penalties (e.g., HIPAA fines in healthcare).

- Ensures audit readiness for stakeholders and regulators.

10. Adapting to Regulatory Shocks

When laws like the No Surprises Act (healthcare) or GDPR (B2B) change, humans rapidly update workflows, retrain AI models, and retool compliance protocols. The impact:

- Minimizes revenue disruption during regulatory transitions.

- Positions your business as a compliant, trustworthy partner.

AI drives efficiency, but humans deliver strategy and relationships—the twin engines of sustainable revenue growth. By combining both, your business can reduce costs, accelerate cash flow, and future-proof Revenue Cycle Management against volatility—all while preserving the human touch that builds loyalty and trust.

Why Does Your Revenue Cycle Management Operation Need AI?

For businesses managing complex revenue cycles—whether in healthcare, insurance, utilities, or other industries—AI is no longer optional; it’s a competitive necessity. The modern revenue cycle is data-driven, high-volume, and customer-centric. Traditional approaches often struggle with communication bottlenecks, manual errors, and the inability to scale efficiently. Here’s why integrating AI into your revenue cycle management (Revenue Cycle Management) operation is essential for business growth and resilience:

1. To eliminate communication bottlenecks that cause lost revenue opportunities.

Delays in responding to customer or payer inquiries, missed follow-ups, and inconsistent messaging can all lead to lost revenue. AI-powered communication tools—such as chatbots, virtual agents, and automated notifications—ensure that every inquiry is addressed promptly and accurately, reducing the risk of missed payments or lost business. AI can handle high transaction volumes and complex interactions, keeping your revenue pipeline moving smoothly.

2. To ensure timely, relevant, and consistent engagement.

AI enables your business to engage customers, patients, or clients with the right message at the right time—across channels like SMS, email, phone, and web portals. By analyzing customer data and behavioral patterns, AI can personalize outreach, send timely reminders, and proactively address issues before they escalate. This level of consistent engagement not only accelerates collections but also enhances the overall customer experience.

3. To free staff from repetitive tasks and reduce errors.

Manual data entry, claim processing, eligibility verification, and routine follow-ups are resource-intensive and prone to human error. AI automates these repetitive tasks, allowing your staff to focus on higher-value activities such as complex problem-solving, customer relationship management, and strategic planning. As a result, your operation becomes more efficient, with fewer errors and lower administrative costs.

4. To gain actionable insights for smarter pricing and inventory decisions

AI excels at analyzing massive datasets to uncover trends, forecast demand, and identify revenue opportunities. In Revenue Cycle Management, this means you can leverage predictive analytics to optimize pricing strategies, anticipate payment behavior, and make informed decisions about resource allocation and inventory management. These insights empower your business to stay ahead of market shifts and maximize profitability.

5. To scale communication without proportional increases in headcount

As your business grows, so does the complexity and volume of revenue cycle interactions. AI-driven systems can handle thousands of simultaneous communications—whether it’s sending payment reminders, verifying insurance, or resolving billing questions—without the need to hire and train additional staff. This scalability ensures that your Revenue Cycle Management operation remains agile and cost-effective, even during periods of rapid growth or seasonal spikes.

And how are industries affected when it comes to AI in revenue cycle management? For

- Healthcare: AI automates prior authorizations, predicts claim denials, and personalizes patient payment plans to reduce bad debt.

- Insurance: AI verifies policyholder eligibility in real time and resolves premium disputes via intelligent chatbots.

- Utilities: AI negotiates payment arrangements via SMS, predicts default risks, and optimizes billing cycles for high-volume customers.

- Telecom: AI flags fraudulent transactions, resolves billing disputes proactively, and offers tailored upsell opportunities during payment interactions.

By eliminating communication bottlenecks, ensuring timely engagement, automating repetitive tasks, delivering actionable insights, and enabling scalable operations, AI empowers your business to capture more revenue, reduce costs, and deliver a superior customer experience—all critical drivers of long-term success

How Can Different Revenue Cycle Management Teams Benefit From AI?

AI in revenue cycle management is revolutionizing how businesses optimize financial workflows, reduce inefficiencies, and maximize revenue generation. Below, we explore how specific teams—Sales, Marketing, Operations, and Customer Service—can leverage AI to address their unique challenges.

Sales Teams

Sales teams often struggle with fragmented data sources, manual forecasting methods, and inconsistent lead prioritization. Without real-time insights, they rely on outdated spreadsheets or gut instincts to predict revenue, leading to inaccurate forecasts and missed targets. Additionally, the inability to identify high-value prospects in a crowded pipeline results in wasted effort on low-potential leads, slower deal closures, and revenue leakage. These inefficiencies create cash flow gaps and hinder growth.

With AI-powered predictive analytics tools analyze historical sales data, market trends, and customer behavior to generate accurate revenue forecasts, reducing guesswork. Automated lead scoring systems prioritize prospects based on their likelihood to convert, enabling sales reps to focus on high-impact opportunities. This accelerates the sales cycle, improves cash flow, and ensures alignment between sales activities and revenue goals.

Marketing Teams

Marketing teams frequently grapple with unclear attribution models, making it difficult to track which campaigns directly contribute to revenue. Siloed data from multiple platforms—such as CRM, email, and social media—creates disjointed insights, leading to inefficient budget allocation. Without a clear understanding of ROI, teams risk overspending on underperforming channels or missing opportunities to scale high-impact campaigns, ultimately limiting revenue growth.

Now, AI unifies cross-channel data to identify correlations between marketing activities and revenue outcomes. Machine learning algorithms assess campaign performance in real time, highlighting which strategies drive conversions and revenue. This enables marketers to allocate budgets dynamically, optimize ad spend, and replicate successful tactics across campaigns, maximizing ROI and accelerating revenue generation.

Operations Teams

Operations teams face repetitive, error-prone tasks such as manual claims processing, eligibility verification, and invoice generation. These manual workflows slow down the revenue cycle, increase administrative costs, and lead to billing errors that trigger claim denials or payment delays. Bottlenecks in processes like prior authorizations or payment posting further extend days sales outstanding (DSO), straining cash flow and reducing profitability.

Here, AI automates routine tasks like claims scrubbing, coding validation, and payment reconciliation, minimizing errors and accelerating processing times. Intelligent workflow tools flag bottlenecks—such as delayed approvals or missing documentation—enabling teams to resolve issues proactively. By streamlining operations, AI reduces DSO, cuts administrative overhead, and ensures faster revenue realization.

Customer Service Teams

Customer service teams are inundated with repetitive inquiries about billing discrepancies, payment deadlines, and plan eligibility. Manual processes for resolving disputes or setting up payment plans lead to long wait times, frustrated customers, and delayed collections. Without personalized insights, agents struggle to tailor solutions to individual financial situations, resulting in lower payment compliance and increased write-offs.

The AI-driven chatbots handle routine queries instantly, freeing agents to focus on complex cases. Natural language processing (NLP) tools analyze customer interactions to detect dissatisfaction or financial hardships, enabling proactive outreach. Predictive models suggest personalized payment plans based on a customer’s history, improving on-time payments and reducing bad debt. This enhances customer loyalty while accelerating revenue collection.

By integrating AI into revenue cycle management, businesses empower each team to tackle their most pressing challenges—from inaccurate forecasting to operational inefficiencies. The result is a seamless, data-driven revenue cycle that maximizes cash flow, reduces costs, and delivers exceptional customer experiences.

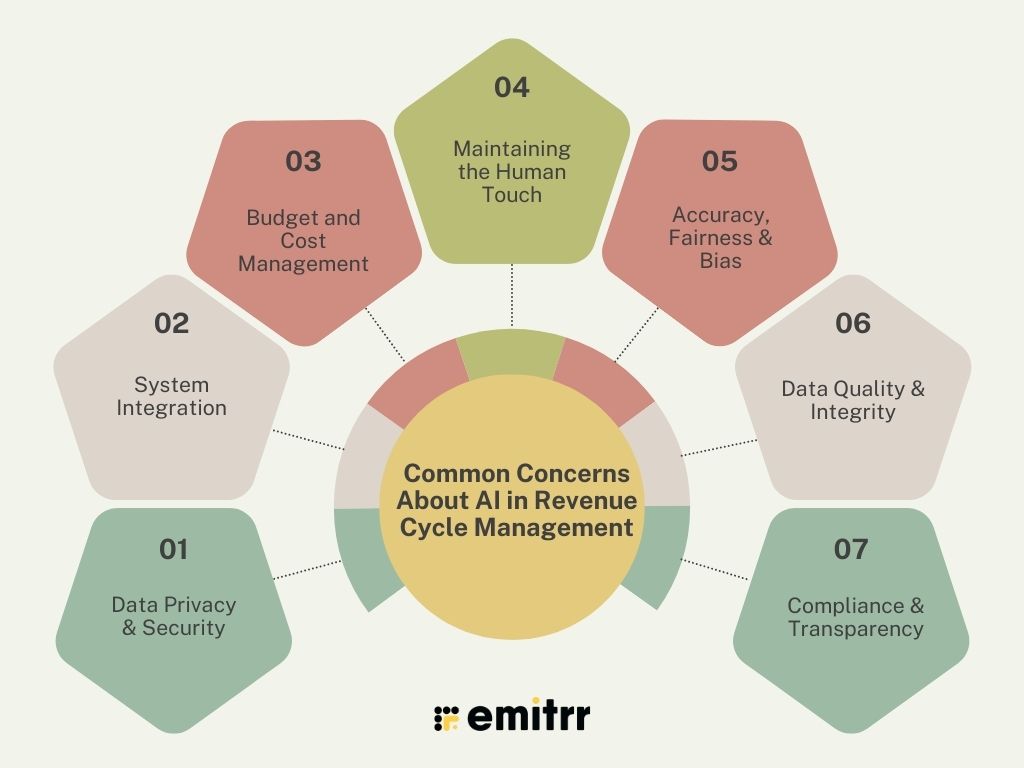

Common Concerns About AI in Revenue Cycle Management

For business leaders considering AI in revenue cycle management, the technology offers significant promise—streamlining workflows, accelerating cash flow, and reducing errors. However, successful adoption requires addressing several key concerns that are especially relevant across industries. Here are seven common challenges and actionable solutions to ensure that AI in revenue cycle management delivers value while minimizing risk:

1. Data Privacy & Security

AI systems in RCM require access to sensitive customer and financial data, raising concerns about data breaches and regulatory compliance. Businesses must implement robust encryption, adhere to industry-specific privacy laws (such as HIPAA or GDPR), and conduct regular security audits. Training AI models with anonymized datasets and establishing strict access controls can further safeguard data and build trust with customers.

2. System Integration

Integrating AI into existing RCM infrastructure—such as CRMs, ERPs, or booking systems—can be complex and costly. Seamless integration is critical to avoid workflow disruptions and ensure data consistency. Businesses should prioritize AI solutions with open APIs and proven compatibility with their current software stack, enabling incremental adoption without overhauling core systems.

3. Budget and Cost Management

The initial investment in AI technology, training, and change management can be a barrier, especially for organizations with tight budgets. To address this, businesses should conduct a clear ROI analysis, pilot AI in targeted RCM processes, and scale up based on proven value. Transparent cost-benefit projections and phased rollouts can help overcome financial hesitation and demonstrate tangible gains.

4. Maintaining the Human Touch

While AI excels at automating repetitive RCM tasks, over-automation risks alienating customers who value personal service. Businesses should use AI to augment—not replace—human teams, reserving staff for complex or sensitive interactions. This hybrid approach ensures efficiency without sacrificing customer satisfaction or empathy.

5. Accuracy, Fairness & Bias

AI models can make mistakes or unintentionally reinforce biases present in training data, leading to unfair outcomes in billing, collections, or approvals. Regularly auditing AI outputs with real-world scenarios, involving staff in decision reviews, and updating algorithms to reflect changing regulations and customer needs are essential for maintaining accuracy and fairness.

6. Data Quality & Integrity

AI’s effectiveness in RCM depends on the quality and completeness of the data it processes. Inaccurate, outdated, or fragmented data can lead to erroneous insights and poor decision-making. Businesses should invest in data cleansing, standardization, and ongoing validation to ensure that AI delivers reliable results.

7. Compliance & Transparency

Evolving regulations and opaque AI decision-making (the “black box” problem) can create compliance risks and erode stakeholder confidence. Organizations should select AI systems with transparent, auditable logic and maintain thorough documentation of AI-driven processes. Ongoing monitoring ensures that AI remains compliant with industry standards and regulatory changes.

By proactively addressing these concerns, businesses across industries can unlock the full potential of AI in revenue cycle management—achieving greater efficiency, accuracy, and customer satisfaction while minimizing risk and disruption.

Human vs AI Operational Output Comparison

| Aspect | Human-Driven Operations | AI-Driven Communication (Emitrr) |

| Availability | Limited to business hours | 24/7, no downtime |

| Response Time | Delays during peak times | Instant, automated |

| Scalability | One interaction at a time | Hundreds simultaneously |

| Data Sync & Accuracy | Manual, error-prone | Automated, near-zero errors |

| Consistency | Variable by staff and time | Uniform, protocol-driven |

| Cost | Salaries, overtime | Predictable subscription model |

Overall Benefits of Communication AI in Revenue Cycle Management

Communication AI tools—like chatbots, automated messaging, and voice assistants—are transforming how businesses manage their revenue cycles. These tools simplify financial workflows by handling repetitive tasks, improving customer interactions, and ensuring faster, error-free communication across billing, collections, and support teams. Here’s how they deliver value to your business:

- Automated Customer Interactions

AI chatbots handle common billing questions, payment reminders, and dispute resolutions instantly, 24/7. This reduces the workload on your customer service team, cuts response times, and ensures customers get answers without long waits. - Personalized Payment Support

AI analyzes customer payment histories to suggest tailored payment plans or discounts. For example, if a customer frequently misses deadlines, the system can automatically offer flexible options, improving on-time payments and reducing bad debt. - Proactive Dispute Resolution

Communication AI spots billing errors or disputes early by analyzing customer messages and transaction patterns. It alerts your team to resolve issues before they escalate, preventing delayed payments and improving customer trust. - Real-Time Updates

AI tools send automated, real-time notifications about payment confirmations, overdue invoices, or claim statuses. This keeps customers informed and reduces follow-up calls, saving time for both parties. - Cost Savings

By automating repetitive tasks like sending payment reminders or updating account details, AI reduces manual labor costs. It also minimizes errors in billing and claims processing, which lowers the risk of denied payments or rework. - Compliance Assurance

AI ensures all communications—emails, chat messages, or invoices—follow industry rules (e.g., HIPAA in healthcare or GDPR for data privacy). It automatically flags non-compliant language or processes, reducing legal risks. - Focus on High-Value Tasks

With AI handling routine queries, your team can concentrate on complex issues like negotiating large contracts or resolving escalated disputes. This boosts productivity and employee satisfaction.

Why It Matters for Your Business?

Communication AI doesn’t just speed up tasks—it creates a smoother, more transparent revenue cycle. Customers get faster, more accurate support, while your team works efficiently with fewer errors. The result? Faster cash flow, lower costs, and stronger customer relationships, all while staying compliant with industry standards.

Like, to reduce claim denials in healthcare with communication AI, Healthcare providers lose billions annually due to claim denials, which delay reimbursements and strain cash flow. Communication AI tackles this by automating error detection, eligibility checks, and patient-provider-payer communication. For example, an AI system can scan claims before submission, flagging missing codes (e.g., ICD-10), incorrect patient data, or non-compliant billing practices. It then automatically alerts staff to fix errors and sends real-time updates to patients about their claim status via chatbots or SMS. Post-submission, AI tracks payer responses, identifies denial patterns (e.g., frequent coding errors), and auto-generates appeals for rejected claims.

How this matters?

Hospitals using such AI tools report 15-30% faster reimbursement cycles and 20-40% fewer denials, directly improving cash flow and reducing administrative burdens. This use case exemplifies how communication AI streamlines the most critical—and costly—stage of healthcare RCM, making it universally relevant across industries that rely on claims or invoice accuracy (e.g., insurance, telecom).

How to Implement AI in Revenue Cycle Management

Step 1:

Audit Existing Workflows

Identify inefficiencies in your current processes—such as delayed billing, manual data entry errors, or high denial rates—to determine where AI can deliver immediate impact.

Step 2:

Select an AI Solution with Seamless Integration

Choose a platform that integrates with your existing tools (e.g., ERP, CRM) to automate tasks like payment reminders, claims processing, and customer communications without disrupting workflows.

Step 3: Automate Core Processes

Deploy AI to handle repetitive tasks:

- Automated reminders for overdue invoices.

- Real-time claim validation to reduce denials.

- Personalized payment plans based on customer history.

Step 4: Train Staff and Refine Collaboration

Educate teams on leveraging AI insights, escalating complex cases, and maintaining a human touch in high-stakes interactions (e.g., disputes or negotiations).

Step 5: Monitor and Optimize

Track KPIs like Days Sales Outstanding (DSO), denial rates, and customer satisfaction. Use AI analytics to refine workflows, adjust communication strategies, and scale successful initiatives.

Key Outcome:

AI transforms your revenue cycle into a proactive, error-resistant system—reducing costs, accelerating cash flow, and strengthening customer relationships. Start with targeted use cases, measure results, and expand AI’s role to drive long-term growth.

Why is Emitrr the Ideal AI Communication Platform for ?

At Emitrr, we are transforming how teams communicate with patients and clients around the clock, across both voice and text channels. Our AI-powered agents do more than just respond to calls or messages. They act as intelligent front desk assistants, ensuring every inquiry is addressed, every appointment is confirmed, and every follow-up is handled on time.

By automating routine communication tasks, Emitrr helps teams reduce delays, improve billing accuracy, minimize missed appointments, and keep the revenue process running smoothly from start to finish.

Voice AI Agent – Your 24/7 Receptionist That Never Misses a Call

100% Call Capture, Zero Frustration

Our AI Receptionist ensures every call is answered—even after hours. Whether it’s midnight or a busy weekday afternoon, your AI agent provides instant support, capturing every lead and inquiry with a 100% answer rate.

Smarter Scheduling, Less Admin Work

Customers can book, reschedule, or schedule appointments anytime. The AI auto-updates your CRM/EMR/PMS and sends reminders, saving 200+ hours annually and drastically reducing no-shows.

Instant Inquiry Resolution

From pricing to service-related FAQs, the AI Receptionist offers real-time, accurate answers, cutting response time by up to 75% and ensuring consistent customer satisfaction.

Proactive Engagement That Fills Your Calendar

Beyond answering calls, the AI Receptionist reaches out via voice or SMS to confirm bookings, follow up on missed calls, and remind customers about payments, reducing missed appointments by up to 90%.

Intelligent Call Routing

Based on the caller’s needs, the AI routes them to the right team or specialist, reducing wait times by 60% and ensuring faster resolution of urgent issues.

Text AI Agent – Intelligent Conversations at Scale

Automated SMS Conversations

Emitrr’s upcoming Text AI Agent will enable businesses to handle inbound and outbound text interactions intelligently. Whether it’s answering FAQs, scheduling appointments, sending follow-ups, or managing customer queries, the Text AI ensures every message gets a timely, accurate response.

Frictionless Customer Experience

Many customers prefer texting over calling. Emitrr’s Text AI offers a conversational experience, mirroring human-like responses while maintaining context and personalization, making interactions feel natural and seamless.

Reduce Team Workload, Not Responsiveness

With the ability to manage multiple conversations simultaneously, the Text AI scales your support and outreach efforts without increasing headcount, freeing up your team to focus on high-value tasks.

The Future of AI in Revenue Cycle Management

Your organization’s future of revenue cycle management is about overcoming persistent financial and operational bottlenecks that drain profits and slow growth. Today’s RCM is challenged by rising administrative costs, frequent claim denials, manual errors, slow collections, and the complexity of integrating data across multiple systems. These issues not only impact cash flow but also put customer relationships and compliance at risk.

Here’s how AI will empower your team to stay ahead:

1. Proactive & Predictive Communication

No more waiting for payments to slip through the cracks. AI will anticipate issues before they hurt your bottom line. For example, it will flag at-risk accounts, predict late payments, and automatically send reminders tailored to each customer’s behavior. This means fewer surprises, faster collections, and happier customers.

2. Seamless Integration with Analytics & Business Intelligence

Your current systems likely struggle with siloed data and slow reporting. Future AI tools will integrate effortlessly with your existing platforms, turning scattered data into actionable insights. You’ll see real-time dashboards showing cash flow trends, denial patterns, and customer payment behavior—helping you make smarter decisions, faster.

3. Hyper-Personalized Communication at Scale

Generic emails and reminders don’t work anymore. AI will craft personalized messages for every customer, adjusting tone, timing, and channel based on their history. Imagine a customer who always pays late receiving a friendly SMS with a discount for early payment—this level of personalization boosts loyalty and speeds up revenue.

4. Optimized Human-AI Collaboration

Your team’s time is too valuable for repetitive tasks. AI will handle the heavy lifting—like data entry, claim scrubbing, and follow-ups—while your staff focuses on building relationships and solving complex issues. The result? Higher productivity, fewer errors, and a team that’s empowered to drive growth.

Why This Matters for Your Organization?

The future of AI in revenue cycle management isn’t just about technology—it’s about giving your organization the tools to eliminate inefficiencies, reduce costs, and build stronger customer relationships. By adopting AI-driven strategies now, you’ll position your business to thrive in an era where speed, accuracy, and personalization define success. With proactive insights, seamless data integration, and hyper-personalized workflows, your organization can turn its revenue cycle into a competitive advantage. The question isn’t if you should adopt AI—it’s how quickly you can start.

FAQs

AI makes communication smarter by sending personalized messages and handling calls/texts faster, while giving teams useful tips to engage customers better.

Yes, AI easily connects to your existing tools, automatically sharing data to keep everything updated.

Yes, AI uses strong security, like encryption and strict privacy rules, to protect customer information.

Usually a few days to weeks, depending on your needs and how much you want to customize it.

Emitrr offers smarter AI for calls/texts, works smoothly with your tools, and focuses on boosting revenue through better customer communication.

Conclusion

Despite being the financial backbone of any organization, revenue cycle management is plagued by persistent issues like complex billing rules, frequent claim denials, delayed collections, and ever-changing regulations. Manual processes, staff shortages, and siloed technology often make these problems worse, leading to wasted time, lost revenue, and frustrated customers or patients. For many businesses, these challenges feel overwhelming and can stall growth.

AI in revenue cycle management is a true game changer. By automating error-prone tasks, streamlining communication, and providing real-time insights, AI tackles the root causes of revenue leakage—reducing claim denials, speeding up collections, and ensuring compliance even as regulations evolve. With AI, your team can focus on high-value work, while customers get faster, more transparent service.

That’s where Emitrr AI comes in. Emitrr AI is purpose-built to solve these exact revenue cycle pain points for businesses. It integrates seamlessly with your existing systems, automates reminders and follow-ups, flags errors before they cost you, and keeps your revenue flowing smoothly.

Want to see how AI can transform your revenue cycle from a bottleneck into a growth engine? Book a demo with Emitrr AI today and take the first step toward smarter, more profitable revenue cycle management.

4.9 (400+

reviews)

4.9 (400+

reviews)